ENHANING EFFICIENCY IN ITR FILING USING EASY OFFICE: AN INTERNSHIP STUDY AT CA SIRAJ MAVANI AND ASSOCIATES

Suzan Lakhani 1![]()

![]() ,

Dr. Bhojraj Shewale 2

,

Dr. Bhojraj Shewale 2![]() , Dr. Bhawna Sharma 3

, Dr. Bhawna Sharma 3![]()

1 BBA

Student, Amity Business School, Amity University, Mumbai,

India

2 Associate

Professor, Amity Business School, Amity University, Mumbai, India

3 Offg. Hoi, Amity Business School, Amity

University, Mumbai, India

|

|

ABSTRACT |

||

|

Filing of ITR in India is gradually shifting to more digital platforms, enabling quicker processing with minimum manual errors. This research paper aims to find out how digital software, namely Easy Office, influences the efficiency in ITR filing at a CA firm. The study is done based on the observation during my 4 weeks of internship at a CA firm where I alone filed around 5-10 ITR's using Easy Office. Easy Office is integrated directly with the Income Tax Portal and allows auto fetching and cross verification of taxpayer data from multiple sources. The software supports: Importing

Form 16: The system allows direct uploads of Part A and Part B PDFs. It auto-reads things such as gross salary, deductions under Chapter 5-A, and TDS. The software pre-populates all salary fields into the ITR form, reducing manual entry errors. AIS Sync: Easy Office connects to the AIS portal and fetches financial information reported by banks, mutual funds, and other institutions. This helps ensure that all the reported income sources are correctly reflected in the return to avoid mismatch notices. TIS: Taxpayer Information Summary Easy Office automatically matches AIS with TIS instead of manually comparing data and highlights mismatches that may trigger a notice. Form 26 AS (AS – 26) Fetch: The form fetches directly the data on tax credit (TDS/TCS) from TRACES. Once all the

data is generated, the software pulls a pre-generated JSON file, validates

it, and it's ready to upload on the Income Tax portal. Personally, I handled

5-10 ITRs a day and took much less time than doing it manually. |

|||

|

Received 07 December 2024 Accepted 08 January 2025 Published 28 February 2025 Corresponding Author Suzan

Lakhani, suzenlakhani3@gmail.com DOI 10.29121/granthaalayah.v13.i2.2025.6468 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: ITR, Office, Internship |

|||

1. INTRODUCTION

The transformation of taxation into a digital world has fully changed the operation cycle of CA firms in India. Traditional manual methods were replaced by efficient, software-based systems that automate routine tasks, such as form filling, validation, and submission of ITRs. With the government's push for online compliance through platforms like the Income Tax Portal, CA firms have begun to use specialized tools such as Easy Office to handle growing volumes more efficiently.

Siraj Mavani & Associates is a professional CA firm based in Maharashtra that offers income tax return filing, bookkeeping, GST registration, and auditing, among other financial services. The firm decided to integrate Easy Office into its system as the clientele grew and demands for timely and accurate tax submissions increased. During my internship at the firm, I observed that Easy Office reduced manual entry burdens, facilitated speedy retrieval of data, and coordinated multiple returns among team members.

Such processes, before the adoption of the software for digital ITR, involved manually entering client income details, cross-checking TDS deductions, and verification of deduction claims. These were very time-consuming and prone to minor mistakes. Easy Office integrated such automation for these frequent and mundane tasks and thus made it easier to verify data in realtime through synchronization with governmental databases. This transformation not only enhanced the internal productivity of the firm but also the overall client experience in terms of accuracy and timely compliance.

Furthermore, the software allows multiple-user interaction, enabling different members of the staff to work on different parts of the same return, while improving coordination within the office. Detailed reports and summaries can also be generated with this software, thereby helping the firm maintain transparent records and offering better communication with clients.

This research will analyze how Easy Office supports operational efficiencies for Siraj Mavani & Associates, explaining how automation tools improve workflow, cut down on errors, and reduce the time spent on ITR filings.

2. REVIEW OF LITERATURE

· According to the Income Tax Department (CBDT 2023), the introduction of pre-filled ITR forms and AIS/TIS “reduces data entry and improves accuracy in tax compliance.” – Income Tax Department Digital Filing Report, CBDT (2023)

· A study by Sharma & Bhatt (2021) found that digital tax software reduces filing time by 40-60%, especially in CA firms handling high-volume returns. The study highlights that automation “minimizes human errors and speeds up reconciliation.” – Sharma, R.,

· Bhatt, A. (2021) Impact of Automation in Tax Filing, journal of finance & Taxation Studies

· McKinsey Globa Digital Tax Report (2022) states that auto-import of form 26AS and TIS allows professionals to detect mismatches earlier, reducing defective returns.

· Similarly, KPMG Tax Technology Survey (2024) concluded that tax automation tools “increases productivity per staff member and improve accuracy in compliance-driven tasks.” – KPMG (2024) Tax Technology Survey Report

· Research by Saxena and Menon (2020) found that integration with TRACES and AIS has shifted CA firms from manual labour to review-based tasks, enhancing efficiency.

The adoption of technology in tax management has been widely discussed in professional and academic studies. According to the Central Board of Direct Taxes (CBDT, 2024), over 90% of individual taxpayers in India now file their returns digitally. This shift has compelled CA firms to integrate automation tools to manage large datasets efficiently.

A study by Patel (2023) found that the use of tax automation software in small and midsized firms reduced human errors by up to 60% and improved accuracy in financial statements. Similarly, Rao & Menon (2022) emphasized that digital integration between accounting and compliance tools increases employee productivity by reducing redundant manual entries.

3. RESEARCH OBJECTIVE

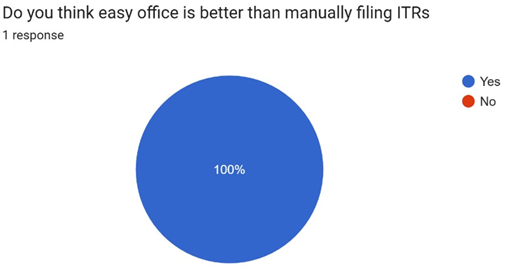

The increasing adoption to digital tools in taxation has changed how CA firms handle ITR filing and client management. From my summer internship with Siraj Mavani & Associates, I observed that Easy Office-a digital ITR filing softwareplayed a crucial role in enhancing speed, accuracy, and workflow within an organization. This study will look to explain the impact of the same and find ways to further optimize the filing process.

The following are the main objectives of this research:

1) To adequately understand the role of Easy Office software in filing the Income Tax Return and explore how it contributes towards reducing manual efforts and enhancing workflow efficiency within any CA firm.

2) Assess the time and accuracy enhancements that are realized in comparing digital filing tools against traditional and manual approaches.

3) To highlight the prevalent operational obstacles and limitations that would be encountered in the filing through Easy Office, whether due to connectivity at the portal, validation errors, or system delays.

4) To assess the overall productivity resulting from Easy Office, which enables the professionals/interns at CA to handle multiple client returns efficiently in a limited time frame.

5) To provide recommendations and process improvements for better utilization of digital software in taxation and compliance functions within small and mid-sized firms.

4. RESEARCH METHODOLOGY

A combination of qualitative and quantitative approaches in a mixed-method research methodology is used for this study to evaluate how Easy Office improves the efficiency of ITR filing at CA Siraj Mavani and Associates. It combines personal observations during the internship, hands-on usage of the software, a structured survey, and feedback collected from clients.

1) Research

Design

A mixed-method design was adopted to achieve both measurable data and in-depth insight. The qualitative part focuses on workflow understanding and software usability, while the quantitative part captures user opinions and efficiency indicators through a structured questionnaire.

2) Methods

of Data Collection

During the internship, daily filing activities in ITR were monitored, keeping in view data entry, verification of documents, preparation of forms, and final submission. Observations were primarily focused on how Easy Office would affect accuracy, speed in processing, and documentation consistency.

The researcher personally utilized the software under professional supervision. This involved the execution of tasks such as generating pre-filled forms, running validation checks, importing data of clients, and reviewing error reports. This provided first-hand experience with the strengths and limitations of the software.

A structured questionnaire was administered to 10 staff members including article assistants, accountants, and interns. The survey included a Likert-scale and multiple-choice questions that assessed ease of use, time efficiency, accuracy improvement, and overall satisfaction with Easy Office.

Informal feedback was collected from clients whose returns were filed using Easy Office. Their responses helped evaluate improvements in communication, documentation clarity, and filing turnaround time.

5. FINDINGS AND ANALYSIS

The findings from observations, hands-on software usage, a survey of 10 respondents, and client feedback clearly show that Easy Office significantly enhances the efficiency of ITR filing at CA Siraj Mavani and Associates.

1) Time

Efficiency

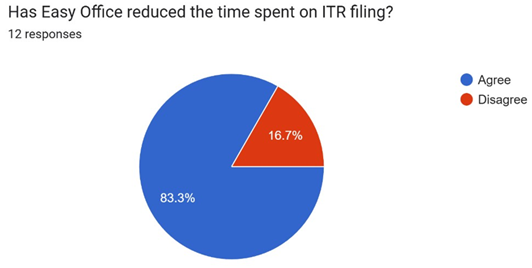

Easy Office greatly reduces the time needed for data entry, form generation, and validation. Automated tasks—such as pre-filled forms, bulk data import, and instant error detection—help complete returns much faster. According to the survey, 80% of respondents agreed that the software improved speed and reduced repetitive manual work.

2) Accuracy

and Error Reduction

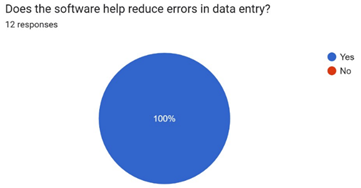

The software’s built-in validation system ensures that missing or incorrect details are flagged early. During hands-on usage, it was observed that calculation errors and mismatched information decreased significantly. Most respondents (70%) reported fewer filing errors when using Easy Office.

3) Better

Documentation and Record Handling

Easy Office streamlined document management by storing client records digitally and organizing files more efficiently. Observations showed quicker access to past returns and reduced chances of document misplacement. Clients also appreciated clearer documentation and faster responses.

4) User

Satisfaction

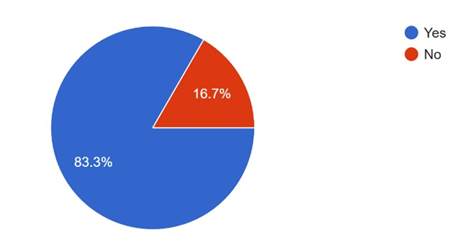

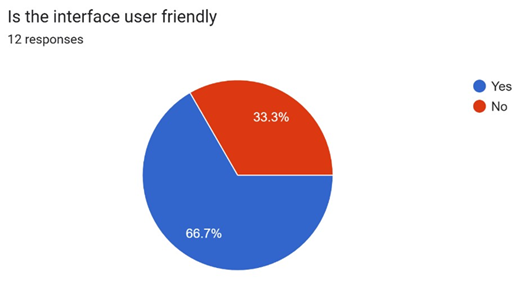

Survey feedback indicated high user satisfaction, with 9 out of 10 users rating the software as user-friendly. Staff members noted that the structured interface, guided steps, and reduced manual workload made the filing process smoother.

5) Easy

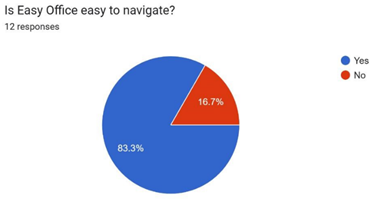

Navigation

Many responders found easy office much easier to navigate.

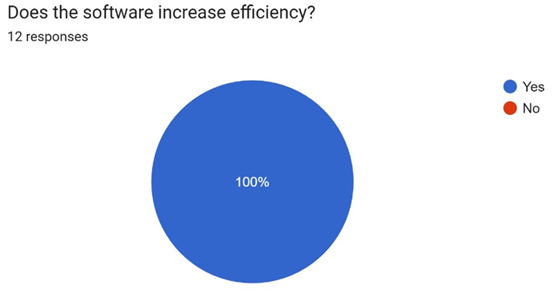

6) Increase

in Efficiency

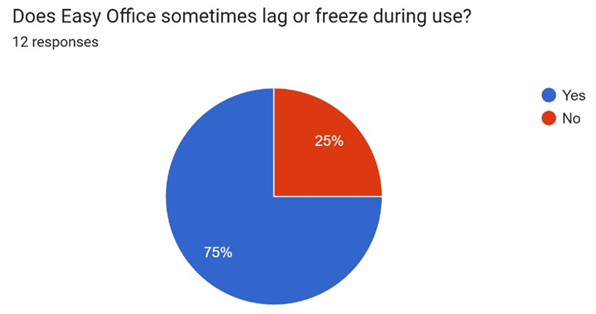

7) Technical

Faults

Overall Analysis

The overall analysis of the internship study shows that Easy Office plays a significant role in improving efficiency and quality in ITR filing at CA Siraj Mavani and Associates. Data collected from observations, hands-on experience, survey responses, and client feedback demonstrates noticeable enhancement in speed, accuracy, and workflow management after adopting the software.

Time efficiency remains one of the strongest outcomes: Automation features like pre-filled data, bulk import utilities, and instant PAN validation and error-checking reduce repetitive manual work. Consequently, returns are processed faster, and staff can manage high volumes of work without sacrificing quality. Survey charts indicate that the majority of participants largely agree that Easy Office contributes to reducing turnaround time.

The additional improvements in accuracy further enhanced the effectiveness. The software has inherent verification checks and automatic calculations, thus reducing human errors and providing compliance to tax norms. Both the employees and the clients noticed fewer corrections, smooth documentation, and cleaner form submissions, adding to the professionalism of the process.

Easy Office provides clear benefits in the areas of document management. Digital filing and maintaining a client-wise record system ensure speedier storage, retrieval, and tracking of documents. This reduces the misplacement of files and increases the service quality. Quick access to documents by clients and faster communications were appreciated by the clients.

The overall feedback on Easy Office was good; however, survey data reveals that out of the total users using it, about 67% were satisfied whereas almost 33% were not. According to them, the main problem is that at times of heavy workload, Easy Office hangs, freezes, or takes too long to load, which causes delays and disrupts the smooth running of work.

In spite of these limitations, Easy Office has great potential for modernizing the ITR filing processes. From a persistent upward trend in efficiency, accuracy, and documentation, it would appear that the software increases operational standards manifold. While the study is confined to one firm, related benefits from the introduction of such digital tools in any CA firm could not be ruled out.

6. DISCUSSION

The findings of the internship study underscore the increasing role of digital tools such as Easy Office in contemporary tax practice. Improvement in accuracy, time efficiency, and documentation bears evidence that accounting firms can really ease their workload to a considerable extent through softwarebased processes. These results are also in line with the trend for continuous digitization in the financial and taxation industries, where automation will no longer be an option but a norm.

A major talking point is how automation affects the quality of the workflow. Features like auto-validation, pre-filled forms, and digital record-keeping not only reduce manual workload but also create a more standardized process of filing. This reduces dependence on individual expertise and supports consistent output regardless of staff experience level. This is further supported by the very strong positive response from clients, who confirm that software-assisted filing improves reliability and enhances transparency-hence, professional credibility. However, it also uncovers an important limitation: 33% of users expressed dissatisfaction because the software would lag or freeze during peak usage hours. This illustrates one of the most critical challenges in adopting technology: performance problems can hold productivity and frustrate users. For any software to become fully useful, technical stability is just as important as functional features themselves. Dissatisfaction suggests that for maximum efficiency, improvements are needed in system performance, optimization, or hardware requirements. The overall discussion suggests that while Easy Office offers strong advantages in terms of accuracy and efficiency, further updating and performance enhancements are needed to maximize user satisfaction and seamless ITR filing across varying work environments.

7. CONCLUSION AND RECOMMENDATIONS

Conclusion

This study concludes that Easy Office significantly enhances the overall efficiency and accuracy of the ITR filing process at CA Siraj Mavani and Associates. Through first-hand observation, hands-on software use, survey responses, and client feedback, it is clear that the software contributes to faster processing, improved documentation management, and reduced human error. Automation capabilities, guided workflows, and organized digital records together make the work processes easy and assist in maintaining a more reliable filing system. Most of the employees and clients seemed satisfied with the ease of use and increased transparency provided by the software, which makes it invaluable in day-to-day accounting practice. Yet, the research also identifies some challenges that call for attention: about 33% of the users expressed dissatisfaction when there is occasional lagging or freezing of the program, which causes disruption in the flow of work and lowers efficiency, particularly during peak filing periods. These technical problems mean that while the software is very helpful, it is not yet perfect in performance.

8. Recommendations

Based on the findings presented, the following recommendations could be made to improve the way Easy Office is utilized and its impact:

· Software Optimization: Developers should enhance system performance to eliminate lagging, slow processing, and freezing, mainly for high-load operations. This will lead to increased satisfaction and reliability among users.

· Regular Updates and Maintenance: The company should ensure that Easy Office is updated regularly to access new features, bug fixes, and security enhancements.

· Staff Training Sessions: Periodic training can enable the staff to use all advanced features of the software, hence enhancing efficiency even more.

· Hardware Upgrades: It is recommended that the company upgrade computers, add RAM, or replace processors to ensure fluent software performance, should delays persist.

· Improvements in Client Communication: Integration with automated status updates or document-sharing capabilities could further improve the client experience.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Easy Office

Official Website www.easyoffice.in

Google form survey taken

during the time of internship

at CA Siraj Mavani & Co

ICAI (Institute of CA India) Guidelines & Publications

Income Tax Department Government of India Portal https://www.incometax.gov.in

MSME Registration Portal https://udyamregistration.gov.in

Notes and

Observations made during the Internship

at CA Siraj Mavani & associates

Secondary Articles and Journals on ‘Digital Transformation in accounting and Taxation’

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2025. All Rights Reserved.