A Study on Practical Applications of Accounting and Financial Management Concepts at JSW Steel

Simran Kohli1![]()

![]() ,

Dr. sameer A Kulkarni 2

,

Dr. sameer A Kulkarni 2![]() ,

Dr. Bhawna Sharma3

,

Dr. Bhawna Sharma3![]()

1 BCOM(A&F)

Student, Amity Business School, Amity University, Mumbai, Maharashtra,

India

2 Associate

Professor, Amity Business School, Amity University, Mumbai, Maharashtra, India

3 Offg. HOI, Amity Business School, Amity University, Mumbai, Maharashtra, India

|

|

ABSTRACT |

||

|

This paper intends to understand the practical applicability of some of the accounting and financial management concepts in large industrial organizations, with special reference to JSW Steel, one of the leading producers of steel in India. The need for this study is to bridge the gap between theoretical learning from classrooms and the actual implementation of financial practices in a corporate setup. Students and interns totalling 45 were surveyed in a structured manner to assess their understanding and experience of practical accounting and financial management during their internship programs. The findings thus show that though students know that these things are important, they cannot apply them properly in real life because of limited exposure, short duration of internships, and restricted access to company data. This study also finds that JSW Steel depends on modern software systems like Tally, SAP, and ERP for ensuring accounting accuracy and financial transparency. This paper

concludes that increasing the duration of internship, mentorship programs,

and practical workshops can significantly improve the learning experience of

the students and subsequently prepare them for professional careers in

finance. |

|||

|

Received 07 March 2025 Accepted 08 April

2025 Published 31 May 2025 Corresponding Author Simran

Kohli, simran.kohli1@s.amity.edu DOI 10.29121/granthaalayah.v13.i5.2025.6466 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords Accounting, Financial Management, JSW Steel, Practical Learning, Internship Experience, ERP Systems, Financial Analysis |

|||

1. INTRODUCTION

Basically, accounting and financial management are two vital elements that ultimately lead to the growth and stability of any business organization. Accounting refers to a process of systematically recording and presenting various aspects of financial transactions so that all the financial activities can be properly documented and presented in the records. Financial management encompasses planning, controlling, and use of financial resources efficiently in an effort to contribute toward the company's long-term goals. They provide, together, a base for informed decision-making and sustainable financial performance.

In large industrial organizations like JSW Steel, huge amounts of data are dealt with by accounting and finance departments day in and day out. They are responsible for maintaining transparency, ensuring that standards set by the government and audit are followed, and analysing financial statements to support business strategies. Financial decisions, such as budgeting, investments, and cost management, rely on accurate accounting data.

Practical exposure to such systems is of utmost importance for students and interns in commerce and finance courses. While classroom theories form the basis, the way these concepts work in real organizations gives them deeper insights. This research paper discusses and emphasizes the practical implementation of concepts of accounting and financial management at JSW Steel and assesses to what extent internships and industrial training contribute to the overall learning of students.

2. FINDINGS

2.1. LITERATURE REVIEW

Several researchers have studied the link between accounting theories and their real-world applications.

· Drury (2019) emphasized that management accounting supports decision-making by providing detailed cost-related information and performance evaluation.

· Pandey (2015) highlighted that financial management ensures the efficient use of funds and helps improve business profitability through proper budgeting and cost control.

· Horngren and Harrison (2016) described accounting as the “language of business,” essential for communicating financial information across departments and stakeholders.

· Kumar and Sharma (2020) suggested that students’ understanding of accounting improves significantly when they are exposed to real organizational practices during internships.

· The JSW Steel Annual Report (2023) also confirms that the company follows Indian Accounting Standards (Ind AS) and uses advanced financial systems such as ERP and SAP to maintain transparency and accuracy.

Overall, previous studies agree that combining theory with practice not only strengthens students’ conceptual knowledge but also enhances their employability and problem-solving ability in finance-related fields.

2.2. Research Methodology

Type of Research: Descriptive and Analytical

Nature of Study: Quantitative and Qualitative

Primary Data: Collected through a structured Google Form questionnaire.

Secondary Data: Collected from JSW Steel's annual reports, academic journals, and reference books.

Sample

Size: 45

respondents

Respondents:

Commerce students

and interns with exposure to accounting and finance activities.

Tool

Used: Questionnaire

and percentage analysis.

2.3. Data Analysis and Interpretation

Data collected from 45 respondents was analysed

question-wise using the percentage method.

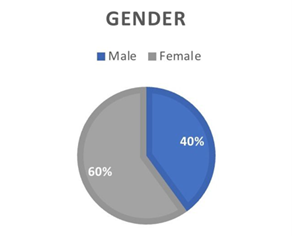

1) Gender Distribution

|

Category |

Percentage |

|

Male |

40 |

|

Female |

60 |

Interpretation: Most respondents were female, reflecting the growing participation of women in finance and accounting studies.

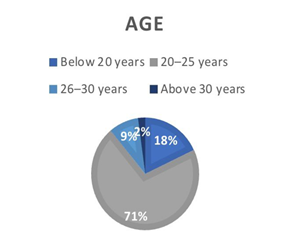

2) Age Group

|

Category |

Percentage |

|

Below 20 years |

18 |

|

20–25 years |

71 |

|

26–30 years |

9 |

|

Above 30 years |

2 |

Interpretation: The highest proportion of the respondents falls into the 20–25-year category, indicating that the majority of respondents were undergraduate students or just graduated.

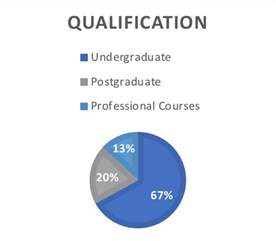

3) Educational Qualification

|

Category |

Percentage |

|

Undergraduate |

67 |

|

Postgraduate |

20 |

|

Professional Courses |

13 |

Interpretation: The highest proportion of the respondents falls into the 20–25-year category, indicating that the majority of respondents were undergraduate students or just graduated.

4) Internship or Training Experience

|

Category |

Percentage |

|

Yes |

80 |

|

No |

20 |

Interpretation: A substantial proportion of the respondents had completed internships in accounting or finance, indicating an increased focus towards practical exposures.

5) Duration of Internship or Training

|

Category |

Percentage |

|

Less than 1 month |

22 |

|

1–2 months |

56 |

|

More than 2 months |

22 |

Most of the internships lasted 1–2 months, which is too little to deeply understand real financial operations.

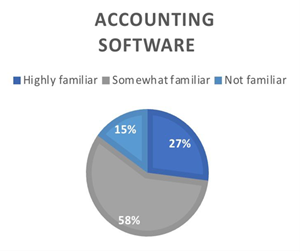

6) Familiarity with Accounting Software

|

Highly familiar |

27 |

|

Somewhat familiar |

58 |

|

Not familiar |

15 |

Interpretation: Most students have basic familiarity with software like Tally, SAP, or Excel but lack advanced exposure to professional tools.

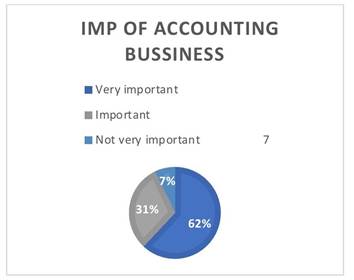

7) Importance of Accounting in Business

|

Category Percentage |

|

Very important 62 |

|

Important 31 |

|

Not very important 7 |

Interpretation: To the majority, accounting is an indispensable part of a company's activities and financial performance.

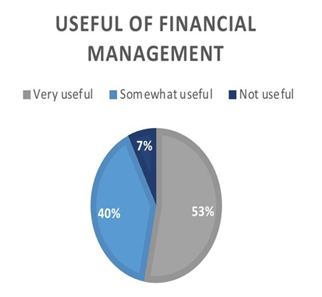

8)

Usefulness

of Financial Management

|

Category |

Percentage |

|

Very useful |

53 |

|

Somewhat useful |

40 |

|

Not useful |

7 |

Interpretation: Respondents agreed on the viewpoint that financial management plays a key role in decision-making, planning, and business control.

9)

Challenges

Faced During Learning

|

Category |

Percentage |

|

Limited exposure |

36 |

|

Short internship |

24 |

|

Lack of guidance |

22 |

|

Complex systems |

18 |

Accordingly, the limited access and time constitute stumbling blocks for most students to learn about real accounting systems.

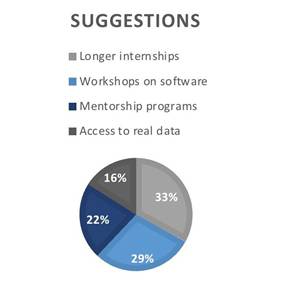

10)

Suggestions

to Improve Practical Learning

|

Category |

Percentage |

|

Longer internships |

33% |

|

Workshops on software |

29% |

|

Mentorship programs |

22% |

|

Access to real data |

16% |

Interpretation: Most respondents suggested more practical training with extended internship opportunities.

2.4. Findings from the Questionnaire

1) 60% of respondents were female, and most were aged 20–25.

2) 67% were undergraduate commerce students.

3) 80% had done an internship related to accounting or finance.

4) The majority used Tally and Excel and were somewhat familiar with them.

5) Accounting and financial management were rated highly important for business success.

6) The main learning difficulties were short internship duration and lack of access to real data.

7) Students agreed that internships helped them connect theory with practice.

8) Most respondents recommended longer internships and practical workshops.

3. Conclusion

The study concludes that accounting and financial management are essential for organisational success and informed decision-making. Students understand their theoretical importance but still require more hands-on experience to apply these concepts effectively.

Internships provide valuable exposure to real business environments like JSW Steel, where accounting systems, budgeting, and cost control are implemented practically. Even though challenges such as time limits and restricted data exist, such experiences greatly enhance student learning and confidence.

4. Recommendations

1) More Practical Workshops: Colleges should conduct regular sessions on Tally, SAP, and Excel.

2) Extended Internship Duration: Students should get at least 2–3 months of exposure.

3) Mentorship Programs: Companies can assign mentors to guide interns through finance tasks.

4) Access to Sample Data: Providing limited but real-type data would help students understand accounting entries better.

5) Industry-Academia Partnership: Universities should collaborate with companies for live projects.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Drury, C. (2019). Management and Cost Accounting. Cengage Learning.

Pandey, I. M. (2015). Financial Management. Vikas Publishing

House.

Horngren, C. T., and Harrison, W. T. (2016). Accounting. Pearson Education.

Kumar, A., and Sharma, R. (2020). Financial Analysis and Applications. McGraw-Hill.

JSW Steel. (2023). Annual Report.

Gupta, S. P. (2021). Practical Applications of Accounting in the Corporate Sector. Indian Journal of Commerce Studies.

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2025. All Rights Reserved.