The Determinants of Angolan Banks’ Efficiency

Clara Pires 1![]()

![]() ,

Carla Santos 2

,

Carla Santos 2![]()

![]() , Nádia Silva 3

, Nádia Silva 3![]()

1 Management Department, Polytechnic Institute of Beja, ESTIG, Rua Pedro

Soares, Campus do IPBeja, 7800-295 Beja, Portugal and

Collaborator CEOS.PP, ISCAP, Portugal

2 Center for Mathematics and Applications (CMA) - FCT- New University of

Lisbon, Portugal and Polytechnic Institute of Beja, Campus do IPBeja, 7800-295 Beja, Portugal

3 International Student, Master’s in Finance and Accounting, Polytechnic

Institute of Beja, ESTIG, Rua Pedro Soares, Campus do IPBeja,

7800-295 Beja, Portugal

|

|

ABSTRACT |

||

|

Globalization has led to a growing increase in financial institutions, as well as to the diversification of their services, due to the international circulation of capital. In view of this increase, the Angolan market has become progressively more competitive, making efficiency a major factor in its survival in the market. This study aimed to analyse the determinants of efficiency in the Angolan banking sector by examining the period from 2014 to 2019. To achieve this objective, we first applied the non-parametric data envelopment analysis methodology to estimate the efficiency levels of banks, and in the second phase, we used a multiple linear regression to obtain an explanatory model of Angolan banking efficiency. In the first stage, the classic Banker, Charnes and Cooper model was used with input orientation, employing the variables of staff expenses and deposits as the inputs, and the total credit as the output, ranking the banks descending order of their efficiency scores. In the second stage, through multiple linear regression, efficiency was expressed as a function of variables measuring the capital adequacy, asset quality, management quality, profitability and liquidity of the banks under study. The variables

that proved to be statistically significant in the efficiency of Angolan

banking were the solvency ratio, the relationship between liabilities and

equity and return on equity. |

|||

|

Received 21 November 2023 Accepted 24 December 2023 Published 08 January 2024 Corresponding Author Clara

Pires, clara.pires@ipbeja.pt DOI 10.29121/granthaalayah.v11.i12.2023.5438 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2023 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Data Envelopment Analysis, Efficiency,

Banking Sector, Angola JEL

Classification: G01, G21, G28 |

|||

1. INTRODUCTION

The financial market constitutes a circuit of financial institutions. These channel savings for investment in financial markets (the capital, credit, foreign exchange and money markets) through the purchase and sale of financial products. Banking activity has, over time, played a very important role in the functioning of any economy Caiado & Caiado (2008). In recent years, banking activity has expanded and includes the financial application of funds raised, with the goal of increasing profits. In this way, banks are trying to recover market segments that they traditionally dominated, but which have been entered by non-banking financial institutions Pires (2009).

According to Caiado & Caiado (2008), “In recent decades, faced with the growing needs of customers, financial institutions have been preparing themselves to respond to operations that sometimes have a specialized nature, however banks, in particular, have to face new challenges, due to the emergence of several phenomena that just over half a century ago were practically non-existent, such as financial internationalization, the globalization of markets, the proliferation of new competitors and their respective products and services and the arising of new technologies”.

Angola’s financial system has been growing continuously. Today, it presents a considerable level of development and sophistication very different from that which prevailed in the first years of national independence. This was the model of a centrally planned economy, inspired by socialism, in which banking and insurance activities were state monopolies Peres (2009). Therefore, according to Ferreira & Oliveira (2018), the Angolan financial system is characterized by growth, resulting from the increase in Angolan banking in the last decade, which began shortly after the end of the long civil war. Angola has become one of the largest economies in Africa. Thus, Angola is a country in the development phase, and its financial system is a decisive factor in its growth.

In recent times, financial institutions have been on the rise, playing a leading role in Angola’s economy, accepting deposits, and granting credit to their customers. As a result of this, and the competitive pressures in the sector, measuring the efficiency of institutions has begun to play a central role in ensuring that banks remain active and competitive in the Angolan market.

There are many methodologies used in the literature to evaluate efficiency in general, but in terms of banking efficiency, several authors use the non-parametric data envelopment analysis (DEA) methodology to quantify efficiency levels. DEA allows for evaluating the efficiency of a set of units that convert multiple inputs into multiple outputs. In addition to quantifying efficiency levels, many scholars seek to analyse the influence of factors determining bank efficiency through internal and external factors.

This article aims to analyse the efficiency and the main factors determining the efficiency of Angolan banks in the period 2014–2019. To estimate the efficiency of banks operating in the Angolan banking sector, this study therefore uses the non-parametric DEA methodology in the first phase and multiple linear regression in the second, methods which have previously been used by many authors in different geographic contexts, such as, for example, Basílio et al. (2015) and Chortareas et al. (2012).

This study seeks to evaluate the efficiency of a set of 16 Angolan banks. The relevant information was gathered from the data available in the reports and accounts of each institution, and their selection involved the consideration of some criteria verified throughout this work.

This paper is structured as follows. Following the

introduction, in the second section we will briefly review the literature,

focusing on the Angolan banking system and banking sector efficiency, as well

as the DEA methodology and the main studies that have considered banking

efficiency. Then, the third section explains the research methodology and presents the

data. Section 4 outlines and discusses the results. Finally, Section 5 provides

the main conclusions.

2. Literature Review

2.1. The Angolan Banking System

Angola is one of the countries in Southern Africa where there have been numerous changes in the financial system. Nevertheless, Angola is currently considered the third-largest economy in Sub-Saharan Africa, after Kenya and Tanzania, with the highest amount of banking activity, which in a certain way strengthens the country’s stability on several levels InforBANCA. (2009). Months before the country’s national independence was declared in August 1975, the act known as “Taking the Bank” was carried out, with the intended function of directing and coordinating the credit institutions that saw their governing bodies suspended. At that time, in addition to the Bank of Angola, which was the issuing and commercial bank, five other banks also operated in Angola, namely Banco Comercial de Angola (BCA), Banco de Crédito Comercial e Industrial, Banco Totta Standard of Angola, Banco Pinto & Sotto Mayor and Banco Inter Unido, as well as four special credit establishments, specifically, the Angola Credit Institute, Banco de Fomento Nacional, Caixa de Crédito Agropecuário and Montepio de Angola InforBANCA. (2009).

The legal and economic framework of Angolan banking activity later underwent its first changes in 1991, when, after being an exclusive activity of the state, the banking business was extended to the private sector. A two-tier banking system was established, with the first level involving the National Bank of Angola, which was charged with the functions of a central bank, acting as the issuing bank and supervisor of the financial system, and the second level including commercial and investment banks InforBANCA. (2009).

In Angola, the structure of the financial system is essentially made up of banking financial institutions (banks) and non-banking ones that involve exchange offices with remittance services, as well as microcredit, credit cooperative and leasing companies, and companies providing payment services such as mobile banking Banco Nacional de Angola. (2019). The country’s current macroeconomic context reflects the consequences of a deficient and improper management of excessive resources that occurred over decades due to the crisis that the country underwent, and financial institutions have not been oblivious to this trend.

According to a Deloitte. (2018), “given the difficulties faced, financial institutions adopted unconventional solutions to increase funds, moving away from its main role economy”. These difficulties resulted, in part, from the need for banks to recover overdue loans. These issues were a consequence of the bankruptcy of many companies and the reduction in sales. On the other hand, some of these companies did business with the state, which also did not repay the credit taken.

The non-repayment of credit by the state, as a consequence, diminished the operational capacity of many companies, which caused the high growth in “non-performing loans” observed today, particularly in banks and in the economy in general Deloitte. (2018). It should be noted that the state has a very significant presence in the banking sector, both directly, through participation in the shareholder structure of the three public banks – namely the Banco de Poupança e Crédito (BPC), the Banco de Comércio e Indústria (BCI) and the Banco de desenvolvimento Angolano (BDA) – and indirectly, through Sonangol, Banco Angolano de Investimentos (BAI), Banco Económico, Banco de Fomento Angola (BFA) and Banco Caixa Geral Angola (BCGA). According to Deloitte. (2018), this could be one of the biggest factors in the disparity and conflict of interests in the credit granting process.

However, as mentioned by Peres (2009), 4–7, “with the increasing modernization of the Angolan financial system, in particular the banking system, other national and foreign operators arrived in this very important range of activity and financial intermediation, a decisive pillar for economic and social development of the country”.

To clarify the high growth of the Angolan banking sector, Table 1 presents the changes recorded during the last 4 years (2016–2019) of financial institutions, through some indicators Deloitte. (2020) considered important for measuring the growth of the sector: assets, net credit to customers, customer deposits, financial margin, banking product and net income for the year.

Table 1

|

Table 1 Growth Indicators for the Angolan Banking Sector |

||||

|

Growth indicators |

2016 |

2017 |

2018 |

2019 |

|

Assets |

0.22 |

0.03 |

0.25 |

0.11 |

|

Net credit to customers |

0.19 |

-0.03 |

-0.06 |

-0.1 |

|

Customer deposits |

0.21 |

-0.01 |

0.31 |

0.13 |

|

Financial margin |

0.54 |

0.08 |

0.24 |

-0.05 |

|

Banking product |

0.31 |

-0.03 |

1.04 |

-0.11 |

|

Net income |

0.45 |

-0.06 |

2.03 |

-0.76 |

|

Source Adapted from Deloitte.

(2020) |

||||

According to information collected from the financial statements of Angolan banks, in 2019, the assets of the national financial system grew by 11%, having increased at a more moderate pace than in 2018. Regarding net credit to customers, this indicator showed a relevant decrease of 10%, to which the reinforcement of credit impairment losses made in the 2019 financial year contributed significantly. On the other hand, the growth indicator relating to customer deposits presented a value of 13%, lower than that recorded in 2018. With regard to the financial margin, this indicator exhibited a decrease of 5% compared to 2018. Finally, banking income and net income for the year demonstrated decreases of 11% and 76%, respectively, compared to 2018, values that completely contrast with the significant growth seen in 2018. As announced by the Angolan newspaper and BAI (2020), BAI was viewed as the best bank in Angola by Euromoney magazine in 2019, for its commitment to improving the services it provides to its customers through information and communications technologies, which has increased the number of people with access to banking services. On the other hand, this bank was also considered the largest in Angola for having total assets of 2,641 billion kwanzas, and for being the one with the largest volume of deposits taken at 2,285 billion kwanzas Deloitte. (2020).

According to the ANGOP report (2019), among the 26 financial institutions operating in the Angolan banking market, six banks represent a share of 77%, namely BPC, BAI, BFA, Banco Económico, Banco Millennium Atlântico and Banco Internacional de Crédito (BIC). The remaining 20 banks compete for 23% of the market share.

2.2. Banking Sector Efficiency – The DEA Methodology

According to Maximiano (2000), the efficiency of a system depends on how its resources are used. Efficiency therefore relates the effort and the result. The smaller the effort required to produce a result, the more efficient the process. Farrell (1957), one of the pioneers in the study of the topic, characterized total efficiency as decomposed into two types: technical and allocative or price efficiency. Later, Havrylchyk (2006) classified efficiency into three types: technical, allocation and total economic cost efficiency. Technical efficiency is related to the ability of an organization to produce maximum results (outputs) with a given level of production factors (inputs), or the ability to minimize the use of production factors (inputs) to obtain of a certain level of results (outputs).

We can view inputs as representing the resources that are used by the organization in its activity, while outputs are obtained with the use of these resources. According to Hasan (2012), “an efficient financial institution is one that, given a certain level of inputs, obtains maximum output results, as well as one that minimizes the inputs used to obtain certain levels of outputs”. Therefore, it can be said that banking efficiency is achieved when the financial institution can minimize its inputs to maximize its outputs. Financial institutions that use a high level of inputs to obtain a low level of outputs are considered inefficient Mester (1997). The DEA technique is empirically based (with the construction of the frontier from available data), unlike competing parametric approaches Marques & Silva (2006). This methodology was proposed by Charnes et al. (1978), who developed it based on the model proposed by Farrell (1957), converting the technical efficiency measure obtained by the initial model (based on an input/output process), to a multiple input/output process. DEA is classified as a non-parametric methodology because it does not use an identical predefined production function for all organizations in the analysis of the resource-product-efficiency relationship Martins (2012).

According to Martins (2012), the objective of the DEA methodology is to compare a set of decision-making units (DMUs) with similar characteristics or that perform similar tasks but consume different levels of inputs and/or produce differing levels of outputs. By identifying efficient DMUs, the DEA methodology allows for measuring and locating inefficiency and estimating a piecewise linear production function, which provides a benchmark for inefficient DMUs.

The DMUs obtain an index representing their relative performance, making it possible to determine which levels of consumption (input) and production (output) would make them efficient through efficiency scores. The scores generated by this model range between 0 and 1 (equivalent to 0 and 100%), with efficient units having an index value equal to 1, where the closer it is to 1, the more efficient the DMU will be. When it is equal to 1 it will be on the production frontier, indicating that it is efficient. On the other hand, the closer the score is to 0, the less efficient the DMU will be, and consequently, it will be further away from the production frontier. Note, however, that having an efficiency index of 1 does not necessarily correspond to being an efficient DMU in absolute terms, but only to being more efficient than the other DMUs included in the sample Junior et al. (2018), Martins (2012).

2.3. Studies of Banking Efficiency

Farrell (1957) is considered the first author who addressed the measurement of productive efficiency. He assessed technical efficiency through the envelope curve and argued that combinations of inputs and outputs would only be efficient if they were on the production frontier. Since then, many studies on banking efficiency have been developed in various countries, analysing varying periods and applying differing methods. Therefore, many investigations have been carried out on this topic, but few are related to the African context and the specific case of Angola. Beck & Cull (2013) studied the banking sector in Africa, taking stock of the current state of banking systems in Sub-Saharan Africa and presenting proposals for innovations that could help the continent make the shift towards more traditional banking models.

Another study, focusing on the African continent, was carried out by Triki et al. (2016), who highlighted issues related to the regulation and efficiency of African banks. This analysis, involving 42 countries, used the DEA methodology. The authors emphasized that regulations must be created and adapted to the level of risk and the size of the banks. On the other hand, to analyse how the efficiency of these banks was achieved, they presented factors such as requirements related to the overall rigor of capital adequacy and transparency, restrictions on entry into and exit from the banking sector as well as banking activities, liquidity and diversification requirements, price controls, the availability of financial safety nets and the quality of supervision. It should be noted that this study concluded that some factors reduce the efficiency of banks, such as price control and liquidity and diversification requirements, and others improve it, such as the availability of financial safety nets and the quality of supervision.

Yannick et al. (2016) evaluated the technical efficiency of the banking sector in Ivory Coast, based on a sample of 14 banks, by applying the DEA methodology to the period from 2008 to 2010. The results revealed that banks do not operate efficiently in terms of loan loss impairment and overdue loans. Furthermore, this study revealed that foreign-owned private banks were relatively more efficient than public banks.

In the context of the European continent, many studies have been carried out in different countries, mostly using DEA as a model to measure the efficiency of banks Altunbas et al. (2001), Basílio et al. (2015), Boucinha et al. (2010), Chortareas et al. (2012), Hauner (2005), Pasiouras et al. (2008), Vilaça et al. (2019). Chortareas et al. (2012) studied the dynamics between the main regulatory and supervisory policies and different aspects relating to the efficiency of commercial banks. This study sample included the data for 22 European Union countries over the period from 2000 to 2008, where DEA was used, and performance measures calculated from ratios obtained based on accounting data were considered. The results suggested that increasing capital restrictions and strict supervisory rules improve bank efficiency. On the other hand, interventionist supervisory and regulatory policies result in higher levels of banking inefficiency.

Another study, carried out in Greece by Pasiouras et al. (2008), examined the association between the efficiency of Greek banks and their share price performance. The analysis involved the data for 10 banks from the period between 2001 and 2005, using in the first phase the calculation of the annual return on the banks’ share prices, and in the second phase the DEA analysis to estimate the banks’ efficiency and finally the regression. The results indicated that the average technical efficiency under constant returns to scale was 0.931, increasing to 0.977 under variable returns to scale. Scale efficiency was 0.953 and technical efficiency was statistically significant and positively related to stock returns, in contrast to scale efficiency, which was not significant.

Still focusing on Europe, Hauner (2005) examined the differences in efficiency between large German and Austrian banks over a 5-year period (1995–1999) and applied DEA for this purpose. The author estimated the cost to income (CTIN) ratio, scale efficiency and productivity with the DEA approach. The results of this study showed that CTIN and productivity did not improve the bank efficiency. Austrian banks were significantly lower in terms of CTIN than German banks. They identified a significant increase in returns to scale, but that returns to scale are negative in the German and Austrian banking systems. Finally, no significant differences were found between the CTIN of private banks and cooperative banks.

Later, Basílio et al. (2015) carried out a comparative study of Portuguese and Spanish banks to analyse their performance and the efficiency from 2008 to 2013, using the DEA model. The sample for this work included 10 Portuguese and 14 Spanish banks. Bank-specific variables (liquidity, capitalization, size, risk, and state ownership) as well as ones external to the bank (gross domestic product [GDP] growth, control of corruption and financial development) were selected. The results showed that Spanish banks were slightly more efficient than Portuguese banks, meaning that liquidity is particularly important regarding bank characteristics. Institutional variables such as the level of financial development and control of corruption are very important in explaining the efficiency of banks.

More recently, Vilaça et al. (2019) studied the determinants of the efficiency of Portuguese banks. The analysis focused on the DEA, Charnes, Cooper and Rhodes (CCR) and Banker, Charnes and Cooper (BCC) models, considering the period between the first half of 2005 and the first half of 2017. The authors argued that the size, capital adequacy, seniority and macroeconomic situation of the country are the four factors influencing the efficiency of banks. The results demonstrated that bigger institutions are more efficient. Investment in Portuguese banking has had a positive influence on the efficiency of the sector. In terms of seniority, younger banks are more efficient. On the other hand, in respect to the macroeconomic situation, banks were less efficient during the crisis period that affected Portugal. However, the analysis indicated that the level of efficiency in the Portuguese banking sector is high, which means that banks operating in this market are efficient in optimizing their resources.

Rostami (2015) evaluated the performance of banks in the period 2005–2014, using the capital adequacy, asset quality, management soundness, earnings and profitability, and liquidity and sensitivity (CAMELS) model for this purpose, and considered some important financial ratios for each component of the model, with Tobin’s Q as the dependent variable. The data for this study were collected from reports and accounts from an Iranian bank, and it was concluded that with the application of this model, banks can focus on risks and some important ratios to control and manage any possible crisis or inefficiency in their performance. These financial ratios are often used to measure the overall financial health of a bank and the quality of its management.

In the context of the Asian continent, the DEA model has been widely used in studies of different countries to measure the performance of banks. To mention just a few of these works, we highlight the investigation by Yang et al. (2019) of the role of regulation in the banking performance of commercial banks in Asia. The paper considered a period of 10 years (2005–2014), using the DEA model to evaluate their performance. Zhang et al. (2012) developed an analysis of 133 commercial banks in Chinese cities on bank risk taking, efficiency and its relationship with law enforcement over a 10-year period (1999–2008). The evaluation was developed using a stochastic distance approach, where it was found that the performance of Chinese banks was strongly influenced by law enforcement, and a better legal environment, enhanced efficiency in the legal system and greater protection of intellectual property rights are associated with a higher level of efficiency among these banks.

More recently, Zhou & Zhu (2017) investigated the efficiency of 12 Chinese commercial banks in the period 2005–2013 based on adverse results (overdue loans), using the super-efficiency slacks-based measure DEA model for this purpose. The outcomes showed that the efficiency of Chinese commercial banks mainly depends on technological progress. On the other hand, the results obtained from the evaluation considering undesirable production and without considering undesirable production indicated that it is necessary to take into account undesirable production when measuring the efficiency of banks, as the result is more authentic and more in line with actual banking operations. Another study was recently carried out by Li (2020) to analyse the efficiency of 101 commercial banks in China during the period 2015–2017, using the bootstrapped DEA approach.

Wanke & Barros (2014) focused on the efficiency of the Brazilian banking sector using a two-step process. The first stage considered cost efficiency and the second stage production efficiency. The results indicated that Brazilian banks are heterogeneous, meaning that some are focused on cost efficiency and others on productive efficiency. Henriques et al. (2018) also analysed Brazilian banking, evaluating banking efficiency in the period from 2012 to 2016 through DEA in a dataset of 37 Brazilian banks made available by the Central Bank of Brazil. They analysed the efficiency of banks using the two classic DEA models, obtaining higher efficiency levels in the BCC model compared to the CCR model. The results of this study indicated that the largest banks are not necessarily the most efficient. Therefore, the inefficiency of Brazilian banks is somewhat more related to technical and administrative issues and larger banks have more opportunity for improvement in this aspect. On the other hand, the authors argued that the sector’s efficiency could be improved if policies were adopted to increase the participation of the smallest banks in the sector, which is currently highly dominated by the 10 largest banks.

Later, a new estimation method, called two-stage geographically weighted maximum likelihood estimation, proposed by Simar & Wilson (2007), was used in several studies. Wasiaturrahma et al. (2020) analysed the efficiency performance of conventional and Islamic rural banks in Indonesia using DEA in the first phase, and the Tobin estimate in the second phase. Many evaluations have been carried out using two-stage DEA. Henriques et al. (2020) carried out a systematic review of the banking literature on DEA in two stages, analysing 59 articles from various study perspectives.

This literature review has revealed that the non-parametric DEA method is one the most used to measure banking efficiency, especially the two-stage DEA which makes the investigation more complete. However, there is no consensus among authors regarding which model should be utilized, and there are several factors that can influence banking efficiency.

3. Data and Methodology

In this study, efficiency and its determining factors in the Angolan banking sector have been analysed. For this purpose, 16 banks (Table 2) operating in Angola were selected for analysis over a period of 6 years (2014–2019).

Table 2

|

Table 2 Banks Selected for Analysis |

||

|

Nº |

Sigla |

Name |

|

1 |

BAI |

Banco

Angolano de Investimentos |

|

2 |

BCA |

Banco

Comercial Angolano, S.A |

|

3 |

BCGA |

Banco

Caixa Geral Angola, S.A |

|

4 |

BCH |

Banco

Comercial do Huambo, S.A |

|

5 |

BCI |

Banco

de Comércio e Indústria, S.A |

|

6 |

BDA |

Banco

de Desenvolvimento Angolano |

|

7 |

BMF |

Banco

BAI Micro Finanças, S.A |

|

8 |

BNI |

Banco

de Negócios Internacional, S.A |

|

9 |

BRK |

Banco

Keve, S.A.R.L |

|

10 |

BSOL |

Banco

Sol |

|

11 |

BValor |

Banco

Valor, S.A |

|

12 |

FNB |

Finibanco Angola |

|

13 |

SBA |

Standard Bank de Angola, S.

A |

|

14 |

BFA |

Banco

de Fomento Angola, S.A |

|

15 |

BIC |

Banco

Internacional de Comércio |

|

16 |

BPC |

Banco

de Poupança e Crédito, S.A |

As previously mentioned, to analyse efficiency, the non-parametric DEA approach was used. In addition, the input-oriented model with variable returns to scale (BCC) was applied. Our objective was to assess the efficiency of institutions by minimizing the number of inputs to produce a given quantity of outputs. The efficiency score results were obtained using the Excel solver. Personnel costs and deposits were used as input variables, and total credit was used as the output variable.

In the second phase, the factors determining the efficiency of Angolan banking were obtained through multiple linear regression, using SPSS software. The results obtained in this study will be presented in Section 4. The application of the DEA methodology implies the selection of variables that can be grouped into inputs and outputs, since the measurement of efficiency is constructed through the comparison between the inputs that are consumed and the outputs that are produced Coelli et al. (2005). The inputs are associated with available resources, in this case, expenses related to personnel and bank deposits, and the output is associated with the bank’s total credit. The selection of variables for this study was based on the CAMEL model[1]. and the literature review we carried out, which resulted in the identification of the ones best suited to this analysis. The input variables and the output variable used in this analysis are presented below (Table 3):

Table 3

|

Table 3 Input and Output Variables Used in the DEA Model |

|

|

Variables

in the DEA model |

|

|

Inputs |

Personnel expenses |

|

Deposits |

|

|

Output |

Total credit |

The following independent variables were used to determine an explanatory model for the efficiency of Angolan banking (Table 4).

Table 4

|

Table 4 Independent Variable Indicators (CAMEL Model) |

||

|

Indicators |

||

|

Capital adequacy |

Solvency ratio (RS) Relationship between liabilities and own funds (PCP) Relationship between deposits and own funds |

|

|

Asset quality |

Overdue loans over total loans Measured by loan loss impairment divided by overdue loans (IPCV) |

|

|

Internal factors |

Management Quality |

Cost to income (CTIN) Relationship between personnel expenses and banking product |

|

Earnings |

Return on assets Return on equity (ROE) |

|

|

Liquidity |

Relationship between liquid assets and total assets (ALAT) Relationship between liquid assets and total deposits |

|

4. Results and Discussion

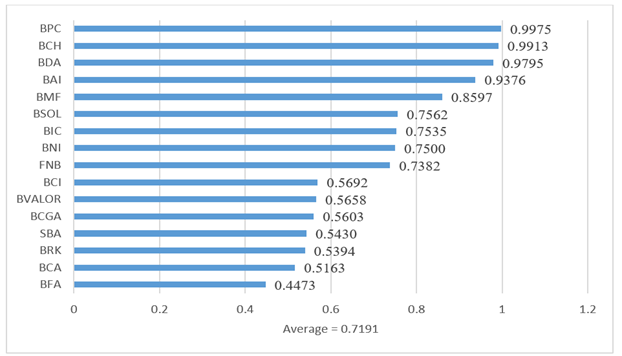

The efficiency results for all banks are presented, measured using the BCC model of Banker et al. (1984), which assumes constant returns to scale. Thus, the results of the efficiency scores obtained from the inputs and output for the sample period are presented in Graph 1.

Graph 1

|

Graph 1 Efficiency Scores Source Own Elaboration Based on Excel |

Graph 1 allows us to visualize the pure technical efficiency scores of each of the banks under study. Therefore, the DMUs are organized in descending order, that is, from the most efficient to the least during the 6 years of the period under study. Thus, according to the results obtained from the input-oriented BCC model, the public bank BPC and the national private bank BCH have higher efficiency scores of 0.9975 and 0.9913, respectively. On the other hand, the national private companies BFA and BCA are those with the lowest efficiency scores, with 0.4473 for BFA and 0.5163 for BCA.

Table 5 shows the descriptive statistics of each of the explanatory variables used to estimate the explanatory model of Angolan banking efficiency.

Table 5

|

Table 5 Summary Statistics of Independent Variables |

||||||

|

Summary Statistics |

||||||

|

RS |

PCP |

IPCV |

CTIN |

ROE |

ALAT |

|

|

Banks |

16 |

16 |

16 |

16 |

16 |

16 |

|

Mean |

175.64 |

39.71 |

16.57 |

269.05 |

102.04 |

1.14 |

|

Median |

122.57 |

37.90 |

9.69 |

227.06 |

106.16 |

1.02 |

|

Std. dev. |

155.50 |

18.472 |

21.18 |

137.35 |

129.48 |

0.52 |

|

Variance |

24179.36 |

341.22 |

448.54 |

18864.29 |

16764.00 |

0.27 |

|

Min |

53.80 |

7.95 |

1.50 |

133.64 |

-73.80 |

0.46 |

|

Max |

658.72 |

77.08 |

86.35 |

615.00 |

441.00 |

2.27 |

|

Source Own elaboration

based on SPSS Software |

||||||

Regarding the mean values of the explanatory variables, the highest values were obtained for the variables CTIN and RS. The variable that presented the lowest values was the relationship between liquid assets and total assets (ALAT). Except for the ALAT variable, the variables have very high dispersion values.

Next, a multiple linear regression model is proposed (Table 6), which aims to

explain the efficiency of Angolan banks.

Table 6

|

Table 6 Regression Results |

|||||

|

Model |

Regression results |

||||

|

Coef. non -standard |

Coef. standard |

t |

p-value |

||

|

B |

Standard error |

Beta |

|||

|

(Constant) |

1.078 |

0.066 |

0.000 |

16.294 |

0.000 |

|

RS |

-0.011 |

0.002 |

-0.732 |

-7.577 |

0.000 |

|

PCP |

-0.018 |

0.004 |

-0.456 |

-4.821 |

0.000 |

|

IPCV |

0.002 |

0.002 |

0.110 |

1.263 |

0.211 |

|

CTIN |

0.001 |

0.001 |

0.125 |

1.433 |

0.156 |

|

ROE |

0.001 |

0.000 |

0.237 |

2.563 |

0.012 |

|

ALAT |

-0.163 |

0.141 |

-0.105 |

-1.153 |

0.253 |

|

Source Own elaboration

based on SPSS software |

|||||

Regarding the relationships and influences that the explanatory variables have on the level of efficiency (or efficiency scores), the following results stand out.

The solvency ratio (RS) and efficiency: this indicator has a statistically significant influence, with its contribution being negative. The RS measures the capacity of the bank’s own funds to absorb risk-weighted assets. Therefore, banks with lower efficiency levels are required to have a higher RS. This conclusion confirms what was noted by Vilaça et al. (2019).

The relationship between liabilities with equity (PCP) and efficiency: the negative contribution of this indicator is due to the fact that liabilities are higher in banks with lower efficiency levels.

The relationship between impairments/provisions on overdue credit (IPCV) and efficiency: this indicator makes a positive contribution, because the most efficient Angolan banks can control overdue loans. This indirectly affects the results, as an increase in this variable implies the creation of more provisions/impairments. Yannick (2016) has also found similar results for this variable.

CTIN and efficiency: the positive contribution of this indicator comes from the fact that banks with higher efficiency levels also have higher operating costs. This result is not compatible with Hauner (2005). We are considering a country with a very different context and level of development. In such cases, comparative analysis becomes very difficult, especially when we refer to CTIN. The banking product in Angola is not one of the main concerns. Increasing economic and social development with sustainability is one of the biggest concerns and there is still a long way to go.

ROE and efficiency: the influence of this indicator is significantly positive. A bank that presents a positive ROE is a bank likely to generate profits, which means that the most efficient banks present a higher net result.

ALAT and efficiency: this indicator presents a negative relationship with efficiency scores. Banks with lower efficiency levels are required to have greater liquidity in their assets to cover their obligations. This result confirms the conclusions of Triki et al. (2016) and Basílio et al. (2015). The liquidity of assets is an indicator where it is more common to have some similarity with less developed countries, where financial difficulties are common and diverse.

In summary, the variables that were statistically significant in the efficiency of Angolan banking were RS, PCP and ROE.

Several studies have been developed on this topic. However, few relate to the African context and even less focus on Angola. Therefore, it is not possible to compare our study with the works of Yang et al. (2019), Zhang et al. (2012), Zhou & Zhu (2017), Wanke & Barros (2014), Henriques et al. (2018) or Henriques et al. (2020), among others. The financial realities of various countries, particularly Asian ones, are quite different. Asia is the continent with the highest economic growth in the world. These authors present, in their works, very important variables, but ones which are difficult to compare with the Angolan context. For example, these include the legal environment, data protection and intellectual capital, among others.

This study represents an important contribution to the literature on Angola. This work is innovative in terms of the sample and the set of explanatory variables used, as well as the model applied. This model had not previously been used to analyse banking efficiency in Angola.

The main objective of this work was to analyse the efficiency of Angolan banks, as well as to identify the main factors determining the efficiency of these same banks for the period 2014–2019. The study of banking efficiency has received increasing attention from researchers around the world, given the influences that financial institutions face in the competitive market, and the importance that the banking sector has in countries’ economies.

In this context, and with the purpose of achieving the established objective, an exhaustive literature review on this topic was carried out. The literature on banking efficiency is very extensive. The authors use a set of methodologies that can be divided into parametric and non-parametric types for the assessment of banking efficiency. Of these methodologies, the non-parametric DEA, which is frequently used, stands out due to its relevance and applicability. In recent times, authors have used the two-stage DEA model proposed by Simar & Wilson (2007), with the aim of minimizing the limitations inherent to this methodology. On the other hand, it is also clear from the literature review that the factors that influence the efficiency of the banking sector come from internal and external (macroeconomic) factors.

This study focused on analysing efficiency in two phases. In the first phase, the classic BCC model was used with input orientation, which allowed for estimating the levels of basic technical efficiency for the 16 banks over a time horizon of 5 years. In the second phase, using multiple linear regression, and with the results obtained from the efficiency levels, it was possible to estimate a model that explained the efficiency of Angolan banks, as well as the main factors determining it.

The results obtained from the first phase of this study show that Angolan national banks are more efficient than foreign banks. The national banks were very efficient in optimizing their resources in the period from 2014 to 2019. That said, based on these results, the public bank BPC and the national private bank BCH were the most efficient banks in the entire sample, revealing a sample of 99.75% and 99.13%, respectively. On the other hand, the national private companies, BFA and BCA, were those with the lowest efficiency scores, 44.73%, and 51.63%, respectively.

Regarding the second phase of this study, the estimation of the explanatory model involved the selection of financial indicators (based on the literature review and CAMEL model) which could influence Angolan banking efficiency. Based on the six variables chosen (RS, PCP, IPCV, CTIN, ROE and ALAT), multiple linear regression was therefore used to identify the set of variables that maximized the relationship between the dependent variable (efficiency scores) with the independent variables (the set of indicators already described above). Therefore, the estimated model suggests that RS, PCP and ROE significantly influence the efficiency of Angolan banking institutions.

This work is an important contribution to studies on Angola, as it is innovative in terms of the sample and the set of explanatory variables chosen, in addition to the model applied. This model had not previously been used to analyse banking efficiency in Angola. However, this paper has some limitations, namely the period chosen for analysis. We suggest that a comparison should be made of the periods before and after the pandemic. We recommend that future research should extend the sample (to after the pandemic) and incorporate external variables, for example GDP, interest rates and inflation targets, which may potentially explain Angolan banks’ efficiency in greater detail.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Altunbas, Y., Gardener, E. P., Molyneux, P., & Moore, B. (2001). Efficiency in European Banking. European Economic Review, 1931-1955. https://doi.org/10.1016/S0014-2921(00)00091-X.

Banco Angolano de Investimentos. (2020). Relatório Semestral de Conjuntura Económica.

Banco Nacional de Angola. (2019). Relatório de Estabilidade Financeira.

Basto, M. T. (2016). A Performance Dos Bancos em Portugal No Período de 2005-2014: Uma Perspetiva. [Unpublished master's dissertation]. Universidade do Algarve.

Basílio, M. D., Pires, M. C., & Reis, J. F. (2015, 28 July). Portuguese Bank's Performance: Comparing Efficiency with Their Spanish Counterparts. https://doi.org/10.1007/s40822-015-0033-6.

Beck, T., & Cull, R. (2013, October). Banking in Africa. https://doi.org/10.1596/1813-9450-6684.

Boucinha, M., Ribeiro, N., & Jones, T. W. (2010). Uma avaliação da egficiência dos Bancos Portugueses. In Relatório de Estabilidade Financeira, 125-145.

Caiado, A. C., & Caiado, J. (2008). Gestão de Instituições Financeiras. Sílabo.

Charnes, A., Cooper, W., & Rhodes, E. (1978). Measuring the Efficiency of Decision Making Units. European Journal of Operational Research, 429-444. https://doi.org/10.1016/0377-2217(78)90138-8.

Chortareas, G. E., Girardone, C., & Ventouri, A. (2012). Bank Supervision, Regulation, and Efficiency: Evidence from the European Union. Journal of Financial Stability, 292-302. https://doi.org/10.1016/j.jfs.2011.12.001.

Coelli, T. J., Rao, D. P., O'Donnell, C. J., & Battese, G. E. (2005). An Introduction to Efficiency and Productivity Analysis (2nd Ed.). Springer.

Deloitte. (2018). Governance da Banca Angolana- Desafios e Oportunidades.

Deloitte. (2020). Banca em Análise 2020.

Farrell, M. J. (1957). The Measurement of Productive Efficiency. Journal of the Royal Statistical Society, 253-290. https://doi.org/10.2307/2343100.

Ferreira, M. E., & Oliveira, R. S. (2018, 17 July). The Political Economy of Banking in Angola. African Affairs, 118(470), 49-74. https://doi.org/10.1093/afraf/ady029.

Hasan, M. Z., Kamil, A. A., Mustafa, A., & Baten, M. A. (2012, 10 August). A Cobb Douglas Stochastic Frontier Model on Measuring Domestic Bank Efficiency in Malaysia. PLOS One. https://doi.org/10.1371/journal.pone.0042215.

Hauner, D. (2005). Explaining Efficiency Differences Among Large German and Austrian Banks. Applied Economics, 969-980. https://doi.org/10.1080/00036840500081820.

Havrylchyk, O. (2006). Efficiency of the Polish Banking Industry: Foreign Versus Domestic Banks. Journal of Banking & Finance, 1975-1996. https://doi.org/10.1016/j.jbankfin.2005.07.009.

Henriques, I. C., Sobreiro, V. A., Kimura, H., & Mariano, E. B. (2018). Efficiency in the Brazilian Banking System Using Data Envelopment Analysis. Future Business Journal, 157-178. https://doi.org/10.1016/j.fbj.2018.05.001.

Henriques, I. C., Sobreiro, V. A., Kimura, H., & Mariano, E. B. (2020). Two-Stage DEA in Banks: Terminological Controversies and Future Directions. Expert Systems with Applications. https://doi.org/10.1016/j.eswa.2020.113632.

InforBANCA. (2009, April). O Sistema Financeiro Angolano.

Junior, J. N., Justo, W. R., Rocha, R. d., & Gomes, S. M. (2018). Eficiência Técnica das Escolas Públicas dos Estados do Nordeste: Uma abordagem em dois estágios. https://doi.org/10.61673/ren.2016.409.

Li, Y. (2020). Analyzing Efficiencies of City Commercial Banks in China: An Application of the Bootstrapped DEA Approach. Pacific-Basin Finance Journal. https://doi.org/10.1016/j.pacfin.2020.101372.

Marques, R. C., & Silva, D. (2006). Inferência Estatística dos Estimadores de Eficiência obtidos com a Técnica Fronteira não paramétrica de DEA. Uma Metodologia de Bootstrap.

Martins, A. I. (2012). Avaliação da Eficiência e Identificação dos Fatores Determinantes da Eficiência do Setor Bancário em Portugal.

Maximiano, A. C. (2000). Introdução à administração. Atlas S.A.

Mester, L. J. (1997). Measuring Efficiency at U.S. Banks: Accounting for Heterogeneity is Important. European Journal of Operation Research, 230-242. https://doi.org/10.1016/S0377-2217(96)00344-X.

Ongore, V. O., & Kusa, G. B. (2013). Determinants of Financial Performance of Commercial Banks in Kenya. International Journal of Economics and Financial Issues, 3(1), 237-252.

Pasiouras, F., Liadaki, A., & Zopounidis, C. (2008, 18 July). Bank Efficiency and Share Performance: Evidence from Greece. https://doi.org/10.1080/09603100701564346.

Peres, J. L. (2009). Caraterização do Sistema Financeiro Angolano. inforBanca- O Sistema Financeiro Angolano, 4-7.

Pires, M. C. (2009, November). Análise da Adequação do Rácio Mínimo de Solvabilidade a Realidade Do Sector Bancário Português.

Rostami, M. (2015). Determination of CAMELS Model on Bank's Performance. International Journal of Multidisciplinary Research and Development, 652-664.

Simar, L., & Wilson, P. W. (2007). Estimation and Inference in Two-Stage, Semi-Parametric Models of Production Processes. Journal of Econometrics, 31-64. https://doi.org/10.1016/j.jeconom.2005.07.009.

Triki, T., Kouki, I., Dhaou, M. B., & Calice, P. (2016, July 11). Bank Regulation and Efficiency: What Works for Africa? https://doi.org/10.1016/j.ribaf.2016.07.027.

Vilaça, E., Mota, C., Pereira, A., Silva, E. S., & Vaz, Â. (2019). Determinants of Bank Efficiency: The Portuguese Case.

Wanke, P., & Barros, C. (2014). Two-Stage DEA: An Application to Major Brazilian Banks. Expert Systems with Applications, 2337-2344. https://doi.org/10.1016/j.eswa.2013.09.031.

Wasiaturrahma, Sukmana, R., Ajija, S. R., Salama, S. C., & Hudaifah, A. (2020). Financial Performance of Rural Banks in Indonesia: A Two-Stage DEA Approach. Heliyon. https://doi.org/10.1016/j.heliyon.2020.e04390.

Yang, Z., Gan, C., & Li, Z. (2019). Role of Bank Regulation on Bank Performance: Evidence From Asia-Pacific Commercial Banks. Journal of Risk and Financial Management. https://doi.org/10.3390/jrfm12030131.

Yannick, G. Z., Hongzhong, Z., & Thierry, B. (2016). Technical Efficiency Assessment Using Data Envelopment Analysis: An Application to the Banking Sector of Côte D'Ivoire. Procedia-Social and Behavioral Sciences, 198-207. https://doi.org/10.1016/j.sbspro.2016.11.015.

Zhang, J., Wang, P., & Qu, B. (2012). Bank Risk Taking, Efficiency, and Law Enforcement: Evidence from Chinese City Commercial Banks. China Economic Review, 284-295. https://doi.org/10.1016/j.chieco.2011.12.001.

Zhou, L., & Zhu, S. (2017). Research on the Efficiency of Chinese Commercial Banks Based on Undesirable Output and Super-SBM DEA Model. Journal of Mathematical Finance, 102-120. https://doi.org/10.4236/jmf.2017.71006.

[1] CAMEL is an acronym in which each letter represents a

component of the model: C – capital adequacy, A – asset quality, M –

management, E – earnings (results), L – liquidity. For more details, see Basto

(2016) and Ongore

& Kusa (2013).

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2024. All Rights Reserved.