|

|

|

|

DETERMINATION OF RETAILER’S OPTIMAL POLICY IN A PRICE-SENSITIVE INVENTORY MODEL FACILIATING TWO TYPES OF PAYMENT SCHEME FOR THE CUSTOMERS1 Department of Mathematics, Chandernagore College, Chandernagore, Hooghly, West Bengal, India |

|

||

|

|

|||

|

Received 20 January 2022 Accepted 25 February 2022 Published 14 March 2022 Corresponding Author Subhankar Adhikari, subhankar_adhikari@yahoo.com DOI 10.29121/ijetmr.v9.i3.2022.1129 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2022 The

Author(s). This is an open access article distributed under the terms of the

Creative Commons Attribution License, which permits unrestricted use, distribution,

and reproduction in any medium, provided the original author and source are

credited.

|

ABSTRACT |

|

|

|

This article investigates the effect of

implementation of two types of payment scheme to the customer by a retailer

in an inventory system. Our study is to determine optimal cycle time and

selling price of a commodity when two types of payment scheme namely

immediate payment scheme as well as trade credit policy are available to the

customer. In reality, two trends of payment scheme

are available in business world. Some people want to pay immediately after

purchase while some favors some time delay in payment. From retailer’s point of view, in many

situations, retailer faces scarcity of capital to start his business. Now- a-

day bank loan is available to the retailer at ease. We formulate a

mathematical model keeping in mind all these things. Two tier credit policies

have been considered. First of all, bank offers a

delay period to repay loan. Secondly, retailer also offers a credit period to

customer. Different cases possible owing to

variable duration of credit periods. Our ultimate

goal is to optimize retailer’s profit for different cases arisen in

the model. A numerical example has been posed and discussed in support of the

model. |

|

||

|

Keywords: Inventory, Price, Bank Loan Facility, Two

Types of Payment Scheme for Customers 1. INTRODUCTION

Mathematical modeling in inventory become very attractive day by day

to the researchers and practitioners as problems associated with inventory

has a close relation with business, economy, and finance. Harris

(1913) was first to introduce inventory in mathematical

modeling. There after many developments has been made. Determination of price

of a commodity is very common problem in inventory. General perception is

that decrease in selling price increases demand rate. Abad

(1996) considered dynamic pricing together with lot-sizing

in an inventory model. In another work Abad

(2001). he assumed selling price dependent demand rate for

items which decays instantaneously. After that many inventory model has been

developed taking demand rate as a monotonic decreasing function of selling

price. It should be noted that demand rate may be linear or non-linear

function of selling price. As limitation of capital is a major challenge in

today’s business world, different types of credit policies have a great

impact in that world. Studies based on the effect of inclusion of trade

credit policy in an inventory system have become much attractive to the

modelers and interpreters This work was started by Goyal

(1985). He was the pioneer to include the effect of |

|

||

introduction of single stage trade credit policy in the inventory system. Huang (2003) extended the concept between supplier and retailer. He assumed that retailer’s offered credit period to the customer is less than the credit period offered by the supplier to the retailer. Jaggi et al. (2008) introduced credit linked demand rate in their model. Chung (2013) implemented the concept of two-level trade credit periods in economic production quantity model with storage capacity constraints. Chung et al. (2014) considered the facility of permissible delay in payment in economic production quantity model for deteriorating items. Giri and Sharma (2016) incorporated the concept of permissible delay in payment in a model where demand rate increases linearly with time. Pal (2018) examined the effect of trade credit policy with partial backlogging of shortages. Giri and Sharma (2019) developed inventory model with partial trade credit policy. Tiwary et al. (2018) introduced two level partial trade credit policy in a three-echelon supply chain associated with perishable items. Mandal et al. (2020) introduces reliability in a production inventory model with two tier credit policy. An inventory model with two stage deterioration under the atmosphere of permissible delay option was formulated by Pal et al. (2021).

2. NOTATIONS

|

Q |

Ordering

quantity of the retailer |

|

W |

Purchasing cost per unit item of the

retailer |

|

P |

Selling price per unit item of the

retailer |

|

S |

Set up cost |

|

D |

Demand rate |

|

|

Holding cost per unit item |

|

|

Cycle length |

|

|

Credit period offered by the bank to the

retailer |

|

|

Credit period offered by retailer to the

customer |

|

|

Obtained interest rate |

|

|

Paid interest rate. |

|

|

A fraction portion of the total customer

make immediate payment on purchase of goods |

|

|

Retailer’s inventory level at time |

3. BASIC ASSUMPTIONS

·

A single item is considered

·

Time horizon is infinite

·

Retailer has some capital to arrange

set-up cost. But he has to go for bank loan for

ordering quantity ![]() .

Banks provide a credit period. After that period bank will charge interest for

remaining unpaid amount. Retailer can enjoy interest from sells revenue up to

the time

.

Banks provide a credit period. After that period bank will charge interest for

remaining unpaid amount. Retailer can enjoy interest from sells revenue up to

the time ![]() .

.

·

Obtained interest rate is less than paid

interest rate.

·

Retailer faces two types of customers. One

category wants to pay immediately after purchase of a thing while another

category wants to avail some time delay for making payment.

·

Retailer offers a credit period ![]() to the customer and sells all items by the

time

to the customer and sells all items by the

time![]() .

From the point of category of customer enjoying permissible delay in payment scheme, if buys item at time

.

From the point of category of customer enjoying permissible delay in payment scheme, if buys item at time ![]() arranges payment at time

arranges payment at time ![]() .

.

·

Retailer’s offered credit period is less

than his cycle length![]()

·

Demand rate ![]() is a monotonic function which decreases

linearly with selling price

is a monotonic function which decreases

linearly with selling price ![]() . Exact form of demand rate is

. Exact form of demand rate is ![]() with

with ![]() .

.

4. MODEL FORMULATION WITH JUSTIFICATION

|

|

|

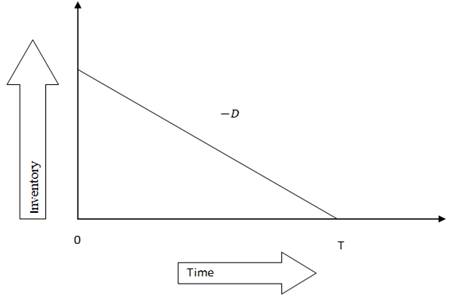

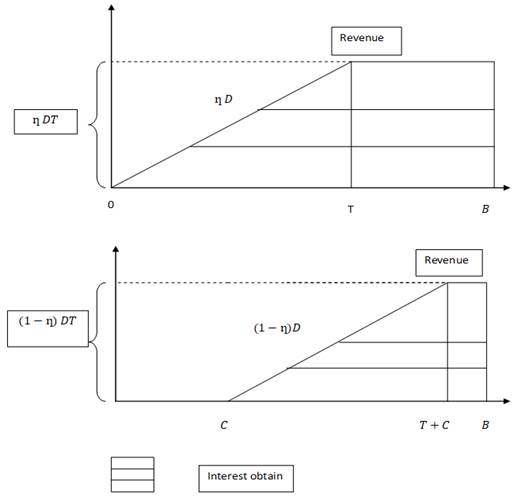

Figure 1 Retailer’s

time weighted inventory |

Retailer

ordering quantity is ![]() .

This amount depletes at the rate

.

This amount depletes at the rate ![]() .

.

The

differential equation which governs inventory level of the retailer is given

below.

![]() subject to initial condition

subject to initial condition ![]() (1)

(1)

Solution is given by

![]() (2)

(2)

Terminal

condition ![]() gives,

gives,

![]() (3)

(3)

Total

holding cost is given as

![]() =

= ![]() [

using (2) and (3)] (4)

[

using (2) and (3)] (4)

Retailer

goes for bank loan for purchasing amount ![]() . So, bank loan amount is

. So, bank loan amount is

![]() . Two cases come up.

. Two cases come up.

Either

Case1. ![]() or

Case2.

or

Case2. ![]() . Now, Case 2 can be subdivided into

three Sub Cases on the basis of the fact that retailer

collects his final payment from the customer at time

. Now, Case 2 can be subdivided into

three Sub Cases on the basis of the fact that retailer

collects his final payment from the customer at time ![]() . Possible three Sub Cases are given

below.

. Possible three Sub Cases are given

below.

Sub Case2.1 ![]()

Sub Case2.2 ![]()

Sub

Case 2.3 ![]()

Now we will discuss all situations with

figures.

Case 1. ![]()

|

|

|

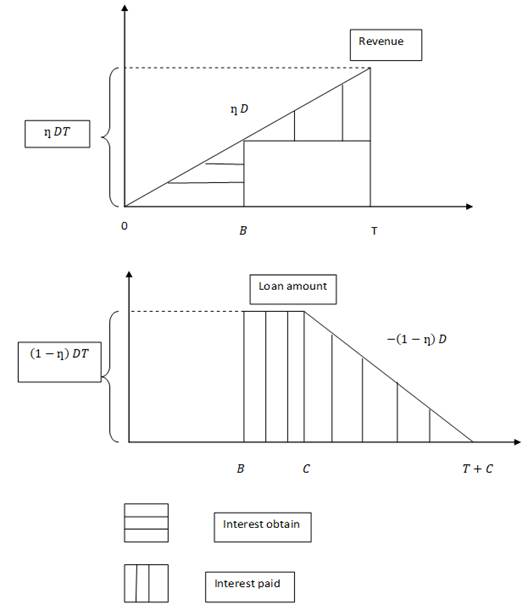

Figure 2 Immediate

payment scheme (above) and trade credit situation (below) under Case 1 |

For

immediate payment, retailer enjoys the interest from sales revenue for the

period ![]() .

He has to pay interest for the period

.

He has to pay interest for the period ![]() .

.

Interest

obtained = ![]() ,

Interest paid =

,

Interest paid = ![]()

For

permissible delay in payment scheme, retailer does not enjoy any interest from

sales revenue. Interest paid = ![]()

Case

2.1: ![]()

|

|

|

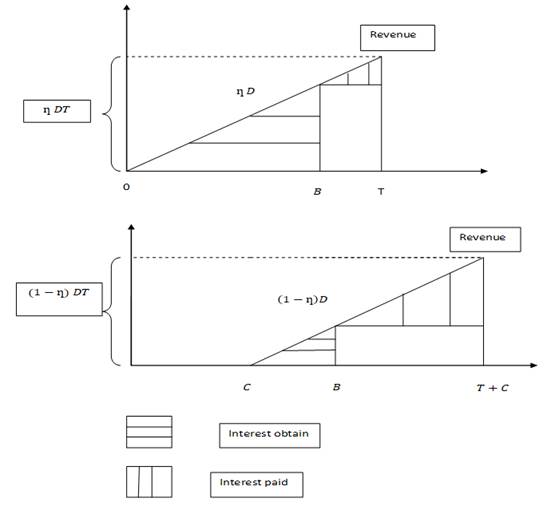

Figure 3 Immediate payment scheme (above) and trade

credit situation (below) under Sub Case 2.1 |

For

immediate payment, Interest obtained = ![]() , Interest

paid =

, Interest

paid = ![]() .

.

For

permissible delay in payment scheme,

Interest

obtained = ![]() ,

,

Interest

paid = ![]()

Case

2.2: ![]()

|

|

|

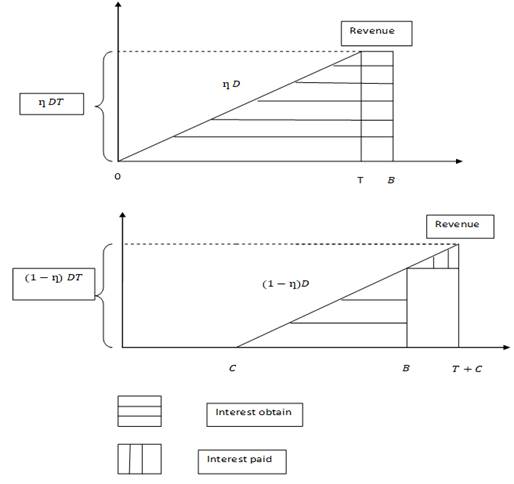

Figure 4 Immediate

payment scheme (above) and trade credit situation (below) under Sub Case 2.2 |

For

immediate payment, Interest obtained = ![]()

Interest

paid = 0.

For

permissible delay in payment scheme,

Interest

obtained = ![]()

Interest

paid = ![]()

Case

2.3: ![]()

|

|

|

Figure 5 Immediate payment scheme (above) and trade

credit situation (below) under Sub Case 2.3 |

Interest

obtained = ![]()

Interest

paid = 0

For

permissible delay in payment scheme,

Interest

obtained = ![]()

Interest

paid = 0

Retailer’s

average profit = (Selling price – Bank loan- Set up cost- Holding cost +

Interest obtained from sales revenue –Interest paid to the bank) / Cycle

length.

Average

profit function of the retailer for different situations is given in the

following table.

|

Table 1 |

||

|

Case / Sub Case |

Profit function |

Expression |

|

1 |

|

|

|

2.1 |

|

[ |

|

2.2 |

|

[ |

|

2.3 |

|

|

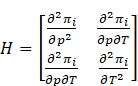

5. SOLUTION METHODOLOGY

We

first solve the following partial differential equations

![]()

Then

we get solutions for cycle length and selling price as ![]() .

These solutions are optimal if the eigen values of the following Hessian matrix

at

.

These solutions are optimal if the eigen values of the following Hessian matrix

at ![]() are negative.

are negative.

6. NUMERICAL EXAMPLE

Values

of parameters for different situations are given below.

Common

parameters to all situations.

|

|

$500 per set up |

|

|

$1.5

per unit |

|

|

$0.07

per annum |

|

|

$0.09

per annum |

|

|

0.3 |

|

|

$6

per unit |

|

|

100 |

|

|

4 |

Parameter

varies along with situations.

|

Case 1 |

Sub Case 2.1 |

Sub Case 2.2 |

Sub Case 2.3 |

|

|

|

|

|

|

|

|

|

|

Optimal

results obtained

|

Case 1 |

Sub Case 2.1 |

Sub Case 2.2 |

Sub Case 2.3 |

|

|

|

$17.56 |

$17.11 |

$16.58 |

$15.99 |

|

|

4.01 |

3.86 |

3.54 |

3.25 |

|

Average

profit |

$99.07 |

$124.10 |

$163.01 |

$238.36 |

Conditions of

optimality

|

Eigen

values of the hessian matrix |

Case 1 |

Sub Case 2.1 |

Sub Case 2.2 |

Sub Case 2.3 |

|

|

|

|

|

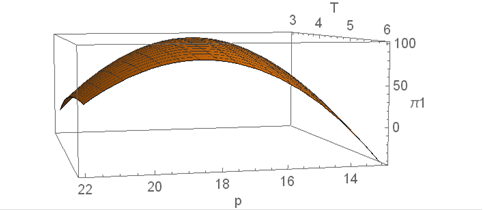

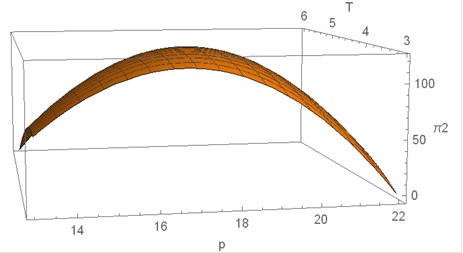

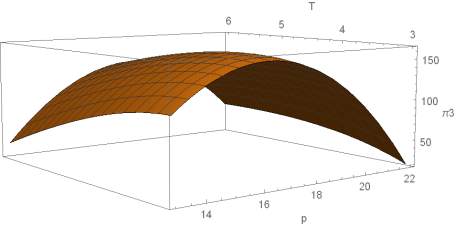

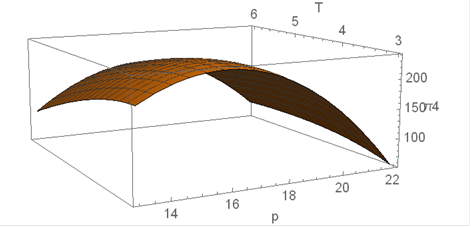

Now we show three-dimensional plotting of retailer’s

average profit function with respect to two decision variables selling price

and cycle length for Case1, Sub Case 2.1, Sub Case 2.2, Sub Case 2.3 respectively.

|

|

|

Figure 6 Profit function for Case 1 with respect to

decision variables selling price (p) and cycle length (T) |

|

|

|

Figure 7 Profit function for Sub Case 2.1 with

respect to decision variables |

|

|

|

Figure 8 Profit function for Sub Case 2.2 with

respect to decision variables |

|

|

|

Figure 9 Profit function for Sub Case 2.3 with

respect to decision variables |

All these diagrams ensure maximization of retailer’s

profit function. This section has been performed with the help of MATHEMATICA

SOFTWARE.

7. CONCLUSION

In this work we have presented a mathematical model which maximizes retailer average profit depending on decision variables namely cycle time and selling price. Different situations associated with two stage trade credit have been considered. It has been observed from numerical results that retailer profit increases as length of the credit period offered by the bank increases. Here we take demand pattern based on selling price linearly. This work may be extended by taking non-linear demand pattern. Also credit linked as well as selling price dependent demand pattern may be a possible extension of this modelling frame work.

REFERENCES

Abad, P.L. (1996), Optimal pricing and lot-sizing under conditions of perishability and partial backordering, Management Science, 42(8) :1093-1104. Retrieved from https://doi.org/10.1287/mnsc.42.8.1093

Abad, P.L. (2001), Optimal price and order size for a reseller under partial backordering, Computers and Operations Research, 28, 53-65. Retrieved from https://doi.org/10.1016/S0305-0548(99)00086-6

Chung, K-J, (2013), The EPQ model under conditions of two levels trade credit and limited storage capacity in supply chain management, International Journal of System Science,44(9),1675-1691. Retrieved from https://doi.org/10.1080/00207721.2012.669864

Chung, K-J, Cardenas-Barron, L.E., Ting, P-S., (2014), An inventory model withnon-instantaneous receipt and exponentially deteriorating item for an integrated three layer supply chain under two levels of trade credit, International Journal of Production Economics,155,310-317. Retrieved from https://doi.org/10.1016/j.ijpe.2013.12.033

Giri, B.C., Sharma, S., (2016), Optimal ordering policy for an inventory system with linearly increasing demand and allowable shortages under two levels of trade credit financing, Operational Research, 16(1),25-50. Retrieved from https://doi.org/10.1007/s12351-015-0184-y

Giri, B.C., Sharma, S., (2019), Optimising an integrated production-inventory system under cash discount and retailer partial trade credit policy. Journal of System Science : Operations and Logistics,6(2), 99-118. Retrieved from https://doi.org/10.1080/23302674.2017.1371358

Goyal, S.K. (1985), Economic order quantity under conditions of permissible delay in payments, Journal of Operational Research Society,36(4),335-338. Retrieved from https://doi.org/10.1057/jors.1985.56

Harris, F.W. (1913), How many parts to make at once, Factory, The Magazine of Management,10(2) ,135-136.

Huang,Y-F.(2003),Optimal retailer's ordering policies in the EOQ model under trade credit financing, Journal of Operational Research Society,54,1011-1015. Retrieved from https://doi.org/10.1057/palgrave.jors.2601588

Jaggi,C.K., Goyal, S.K, Goel, S.K.,(2008), Retailer's optimal replenishment decisions with credit-linked demand under permissible delay in payments, European Journal of Operational Research, 190,130-135. Retrieved from https://doi.org/10.1016/j.ejor.2007.05.042

Mandal, A., Pal, B., Chaudhuri, K.S. (2020), Unrelaible EPQ model with variable demand under two-tier credit financing, Journal of Industrial and Production Engineering,37(7),370-386. Retrieved from https://doi.org/10.1080/21681015.2020.1815877

Pal, B. (2018), Optimal production model with quality sensitive market demand, partial backlogging and permissible delay in payment, RAIRO-Operations Research, 52, 499-512. Retrieved from https://doi.org/10.1051/ro/2017068

Pal, B., Mandal, A., Sana, S.S. (2021), Two-phase deteriorated supply chain model with variable demand and imperfect production process under two-stage credit financing. RAIRO-Operations Research, 55, 457-580. Retrieved from https://doi.org/10.1051/ro/2021008

Tiwary, S., Cardenas-Barron, L.E., Goh, M., Shaikh, A. A., (2018), Joint pricing and inventory model for deteriorating items with expiration dates and partial backlogging under two-level partial trade credits supply chain, International Journal of Production Economics,200,16-36. Retrieved from https://doi.org/10.1016/j.ijpe.2018.03.006

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© IJETMR 2014-2022. All Rights Reserved.