|

|

|

|

IMPLEMENTATION OF CREDIT RESTRUCTURING DURING THE COVID-19 PANDEMIC PERIOD (CASE STUDY ON RURAL BANKS)Fitriana 1, Aloysius

Harry Mukti 2 1 Institute Bisnis Nusantara, Indonesia2 Universitas Bhayangkara Jakarta Raya, Indonesia |

|

||

|

|

|||

|

Received 19 December 2021 Accepted 31 January 2022 Published 17 February 2022 Corresponding Author Aloysius

Harry Mukti, harryaloysius2021@gmail.com DOI 10.29121/ijetmr.v9.i2.2022.1105 Funding:

This

research received no specific grant from any funding agency in the public,

commercial, or not-for-profit sectors. Copyright:

© 2022

The Author(s). This is an open access article distributed under the terms of

the Creative Commons Attribution License, which permits unrestricted use, distribution,

and reproduction in any medium, provided the original author and source are

credited.

|

ABSTRACT |

|

|

|

The

banking sector is one of the sectors affected, several policies to reduce the

impact of COVID-19 have caused productivity to decline, productivity has

decreased, the next impact is hampered liquidity. Rural Bank is a form of banking

on a micro-scale that substantially has a function like banking in general,

where liquidity risk is also one of the risk exposures for Bank Perkreditan

Rakyat Nusantara. In particular. Based on this background phenomenon, further

research will be conducted to examine the health of the bank's financial

ratios and profitability after the impact of the implementation of the credit

restructuring policy at Bank Perkreditan Rakyat Nusantara. The research

method used is a qualitative method with inductive data analysis and

qualitative research emphasizes the meaning or data behind what is observed.

From the results of this study, it can be concluded that in general, the

financial health and profitability ratios at Credit Banks during the Covid 19

period experienced a decline in performance throughout 2020 compared to 2019.

The strategic steps taken by the Nusantara Credit Bank Bona Pasogit 10 during

the Covid 19 period were: (a). Develop an internal policy for restructuring

debtors affected by COVID-19 (b). Establish a team and task force for

handling debtors affected by covid-19 (c). Restructuring debtors affected by

Covid-19 and (d). Reporting to the Financial Services Authority as mandated

in POJK 48/POJK.02/2020. |

|

||

|

Keywords: COVID -19, Liquidity, Credit, Profitability, Restructuring 1. INTRODUCTION The banking sector is

one of the sectors affected, several policies to reduce the impact of

COVID-19 have caused productivity to decline, productivity has decreased, the

next impact is hampered liquidity. The Deposit Insurance Corporation (LPS)

said not all banks were immune to worsening conditions due to the COVID-19

pandemic. Individually, small banks are the most vulnerable to liquidity.

Unfortunately, some small banks will find it difficult to get to the market

and become the most vulnerable due to COVID-19, small banks are the range in

these conditions, because the capital is not large enough, TPF (Third Party

Funds) is concentrated in only a few depositors and the credit risk also

increases. (money.kompas.com, January 2021). The government through

policy instruments that support banking liquidity during the COVID-19

pandemic period is contained in several Financial Services Authority

Regulations (POJK). POJK Number 11/POJK.03/2020 concerning the national

economic stimulus as a |

|

||

countercyclical policy due to the impact of the 2019 corona virus disease spread, article 2 paragraph Ambarwati and Abundanti (2018) provides directions that banks can implement policies that support economic growth stimulus for debtors affected by the 2019 coronavirus disease. including micro, small, and medium business debtors. Furthermore, the technical restructuring policy is contained in Article 2 paragraph Ananto and Ferdawati (2020), policies that support the economic growth stimulus as referred to in paragraph Ambarwati and Abundanti (2018) include: (a). asset quality determination policy and (b) credit or financing restructuring policy.

The ongoing spread of COVID-19 globally and domestically has forced the government to issue POJK Number 48/POJK.03/2020) regarding changes to POJK Number 11/POJK.03/2020. This policy broadly implements that the quality of restructured credit or financing is determined to be smooth since the restructuring is carried out as stated in Article 5 paragraph Ambarwati and Abundanti (2018).

Periodic evaluation of the fundamentals of bank resilience and the principles of prudence are the main factors for the Bank to survive, several indicators of banking health that need to be monitored regularly include (SE Bank Indonesia number 13/30/ DPNP dated December 16, 2011): (a). return on assets or the ratio of profit before tax to average total assets (b). Operating Expenses to Operating Income (BOPO) and credit to third party funds or LDR and (d). The ratio of non-performing loans to total loans or NPL (Non-performing loans). Several previous studies have also emphasized the importance of maintaining bank soundness ratios during the COVID-19 pandemic (Handayani et al, 2020, Tiwu (2020), Sofia (2021), Supeno and Hendarsih (2020), Ilhami and Husni (2021).

Rural Bank is a form of banking on a micro scale which substantially has a function like banking in general, where liquidity risk is also one of the risk exposures for Bank Perkreditan Rakyat Nusantara Bona Pasogit 10 in particular. Based on this background phenomenon, further research will be conducted to examine the health of the bank's financial ratios and profitability after the impact of the implementation of the credit restructuring policy at Bank Perkreditan Rakyat Nusantara.

2. MATERIALS AND METHODS

2.1. METHODS

The method used in this study is a qualitative method, meaning that the researcher will explore the existing problems. According to Bogdan and Biglen in Sugiyono (2015) with their book entitled; Qualitative research for education, An Introduction to theory and Methods, says that qualitative research is an inductive data analysis and qualitative research is more focused on the meaning or data behind what is observed. Researchers play an active role in loading the research plan, and the research implementation process, as well as being the determining factor of the entire research process and results.

2.2. DATA SOURCE AND PERIOD

According to qualitative research theory, in order for the research to be of really high quality, the data collected must be complete, namely in the form of primary data and secondary data (Saban, 2017):

1) Primary data is data in the form of verbal or spoken words, gestures or behaviour carried out by reliable subjects in this case are research subjects (informants) relating to the observations to be studied.

2)

Secondary data is data obtained from documents

in the form of policies and financial reports

2.3. DATA PROCESSING METHOD

In this study, data processing was carried out as

follows:

1)

Analysis

of financial health ratios before and after the Covid-19 pandemic using

financial health ratio indicators, namely

·

KAP

(Quality of Earning Assets) According to POJK Number 33 of 2018, productive

assets are defined as the provision of BPR funds in rupiah currency to obtain

income in the form of credit, Bank Indonesia certificates and placements with

other banks. healthy indicator < 10.35%

·

BOPO

(Operating Expenses to Operating Income) According to the circular letter of

Bank Indonesia Number 13/30 DPNP dated December 16, 2011, BOPO is the ratio of

total operating expenses to total operating income. Healthy indicator < 100%

·

cash

ratio Is a liquid instrument consisting of cash and investments in other banks

against current debt Zahara

(2013). Healthy indicator > 4.05%

·

Loan to Deposit Ratio According to the Circular Letter of

the Financial Services Authority Number 39/SEOJK.03/2017, it is defined as the

ratio of loans granted to third parties to third party funds (including current

accounts, savings, and time deposits). Healthy indicator < 110%

·

Non-Performing Loan (NPL) According to the Circular Letter

of the Financial Services Authority Number 39/SEOJK.03/2017, NPL is defined as

the ratio of the number of non-performing loans to the total credit found in

BPRs. Healthy indicator < 5%

2)

Profitability

before and after the Covid-19 pandemic using the Return on Assets (ROA) ratio,

according to Bank Indonesia Circular Number 13/30 DPNP dated December 16, 2011,

which is defined as the value of profit before tax to total assets. Healthy

indicator >1.5 % (Banking Industry OJK Report, 2015;20)

3. RESULTS AND DISCUSSIONS

3.1. FINANCIAL PERFORMANCE DURING THE COVID-19 PANDEMIC

The indicators of the

financial health of Rural Banks that will be analysed after the implementation

of the credit restructuring policy are: KAP (Quality of Earning Assets), BOPO or operating

expenses to operating income, cash ratio, Loan to Deposit Ratio, Non-Performing

Loan (NPL) and Return on Asset (ROA)

|

Table 1 Earning

asset quality for the period January 2020 – December 2020 (in percentage) |

||||||||||||

|

Jan |

Feb |

Mar |

April |

May |

June |

July |

Aug |

Sept |

Oct |

Nov |

Dec |

|

|

HOOD |

3 |

3.06 |

3.07 |

3.2 |

5.17 |

4.89 |

4.78 |

4.57 |

4.5 |

4.28 |

4.14 |

3.96 |

|

Source: Monthly financial report 2020 |

||||||||||||

In

general, the assessment of the quality of productive assets at Bank Perkreditan

Rakyat Nusantara Bona Pasogit 10 Dolok Songful shows a healthy indicator, the

KAP value is always below the 10.35% indicator, or it means that productive

assets with problems are always smaller than the total productive assets.

Covid-19 impact

analysis, The trend of productive asset quality in 2020 compared to 2019 shows

unsatisfactory results.

|

|

|

Figure 1 KAP

Value Source: Monthly financial reports for 2019 and 2020 |

This can

be seen from the KAP value in 2019 showing the maximum value at 3.11% in

December 2019 and the minimum value at 1.56% in April 2019, but in 2020 there was

an increase with the maximum value in May 2020, namely 5.17% and minimum at

3.00% in January 2020. This result shows that there is an increasing trend of

non-performing productive assets even though the overall condition of KAP in

2020 is in a healthy condition because it is less than 10.35%. The highest

value in May 2020 indicates that the quality of problematic productive assets

is the impact of the Covid-19 pandemic, this increase is due to the ability to fulfil

the obligations of the Debtor which is constrained as a result of the Covid-19

Pandemic.

|

Table 2 Operating

Expenses to Operating Income (BOPO) January 2020 – December 2020 period (in

percentage) |

||||||||||||

|

Jan |

Feb |

Mar |

April |

May |

June |

July |

Aug |

Sept |

Oct |

Nov |

Dec |

|

|

BOPO |

76.63 |

75.84 |

75.75 |

76.37 |

77.73 |

78.57 |

78.64 |

79.11 |

79.01 |

79.51 |

80.07 |

80.89 |

|

Source: Monthly financial report 2020 |

||||||||||||

The BOPO

ratio in 2020 is at its maximum value of 80.89% in December 2020, the smallest

ratio is 75.75% in March 2020, for 2020 BPR Nusantara Bona Pasogit 10 can

maintain performance with an BOPO achievement of below 100%.

Covid-19 impact analysis, in 2020 the trend of growth in the

BOPO ratio shows stable growth.

|

|

|

Figure 2 BOPO

Ratio Source: Monthly financial reports for 2019 and 2020 |

At the

beginning of 2020 the BOPO ratio was shown at 76.63%, in March 2020 it decreased

to 75.75% and continued to grow until at the end of 2020 it reached 80.89%,

this insignificant growth remained in a healthy condition for BPR Nusantara

Bona Pasogit 10 Dolok Sanggul because it keeps the ratio below 100%. The trend

also shows that the BOPO ratio in 2020 has increased compared to 2019, one of

the reasons for this ratio being higher is the relatively declining operating

income as a result of the impact of the Covid-19 Pandemic while operating

expenses have not decreased relatively.

|

Table 3 Cash Ratio

January 2020 – December 2020 period (in percentage) |

||||||||||||

|

Jan |

Feb |

Mar |

April |

May |

June |

July |

Aug |

Sept |

Oct |

Nov |

Dec |

|

|

CR |

19 .13 |

20.65 |

17.17 |

18.29 |

22.27 |

23.46 |

26.23 |

24.96 |

25.94 |

26.6 |

27.64 |

23.5 |

|

Source: Monthly financial report 2020 |

||||||||||||

With a minimum cash ratio

indicator of 4.05%, BPR Nusantara Bona Pasogit 10 in 2020 shows a healthy

condition, the lowest value is in March 2020 with a cash ratio of 17.17% and

the highest in November 2020 with a cash ratio value of 27.64%

Covid-19 impact analysis, the ability to meet current debt in

2020 experienced an increasing growth trend.

|

|

|

Figure 3 Cash Ratio Source:

Monthly

financial reports for 2019 and 2020 |

The cash ratio growth with

the lowest value was in March 2020 with a value of 17.17%. The ability to fulfil

current debt continues to grow up to the highest value in November 2020 with a

value of 27.64%. This condition is inversely proportional to the trend at the

beginning of the year to the end of 2019 which grew below 2020. This is due to

the increase in company liquidity for public deposit funds that rely on BPRs

and on the other hand, caution has given the BPR a decision to redistribute it

into a form of loan. causing increasing reserve

cash which has a higher impact on the ratio.

|

Table 4 Loan

to Deposit Ratio (LDR) January 2020 – December 2020 period (in percentage) |

||||||||||||

|

Jan |

Feb |

Mar |

April |

May |

June |

July |

Aug |

Sept |

Oct |

Nov |

Dec |

|

|

LDR |

64.86 |

64.33 |

67.71 |

66.07 |

59.37 |

55.82 |

55.16 |

56.82 |

57.5 |

57.49 |

57.31 |

59.89 |

|

Source: Monthly financial report 2020 |

||||||||||||

With the indicator of credit

distribution being 110% above third-party funds, in 2020 BPR Nusantara Bona

Pasogit 10 is able to maintain performance while maintaining a ratio below

110%. The highest LDR ratio was in March 2020 with a value of 67.71% and

continued to decline to the lowest in July 2020 with a value of 55.16%.

Covid-19 impact analysis, the trend in 2020 shows growth that

does not fluctuate.

|

|

|

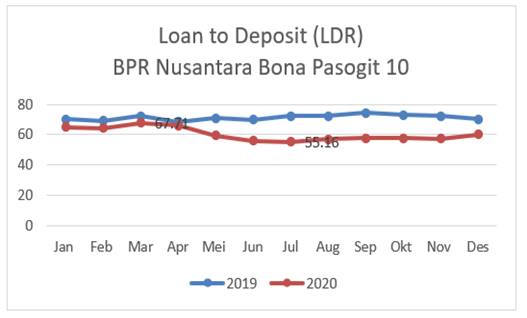

Figure 4 Loan to Deposit Source: Monthly financial reports for 2019 and 2020 |

LDR in 2020 is moving below

the trend in 2019, this is a form of mitigation or conservatism to limit credit

distribution while maintaining liquidity at BPR Nusantara Bona Pasogit 10, the

lowest LDR value in 2020 was in July, namely 55.16% or in other words only half

of the distribution loans from total BPR deposits while the highest LDR ratio

in 2020 was in March 2020 with a value of 67.71%. It can be said that the LDR

ratio has been affected by the Covid-19 Pandemic, but the trend that is below

growth in 2019 is a form of prudence in terms of lending.

|

Table 5 Non-Performing

Loan (NPL) January 2020 period – December 2020 (in percentage) |

||||||||||||

|

Jan |

Feb |

Mar |

April |

May |

June |

July |

Aug |

Sept |

Oct |

Nov |

Dec |

|

|

NPL |

5.33 |

5.82 |

5.37 |

6.4 |

6.64 |

7.36 |

6.88 |

6.66 |

6.47 |

5.91 |

5.85 |

5.38 |

|

Source: Monthly financial report 2020 |

||||||||||||

With the NPL indicator of not

more than 5%, on average based on the 2020 monthly financial reports, BPR Bona

Pasogit shows a value above 5%, the highest value was in June 2020 with an NPL

of 7.36% while the lowest NPL was in January 2020 with a value of 5.33%.

Covid-19 impact analysis, the year 2020 has had a huge impact on

NPL growth for BPR Nusantara Bona Pasogit 10.

|

|

|

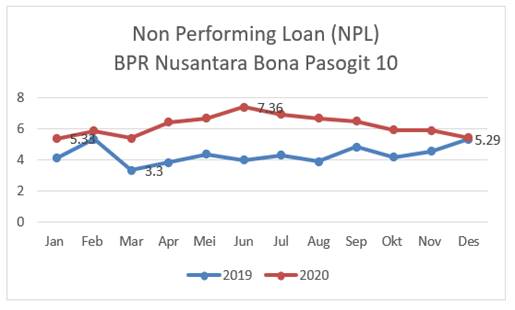

Figure 5 Non-Performing Loan Source: Monthly financial reports for 2019 and 2020 |

This can be seen from several

analyses as follows: Ambarwati

and Abundanti (2018). The 2019 NPL trend moved below the 2020 trend with a minimum value of

3.30% in March 2019 and only one month, namely December 2020, which was above

the provision of 5.29% in December 2020 Ananto

and Ferdawati (2020). The trend of NPL throughout 2020 grew above 5% or above the

provisions, this can be seen from the minimum value in January 2020 of 5.33%

and the highest in June 2020 with a value of 7.38%. NPLs that are above this

indicator are clearly the impact of constrained debtor liquidity, the NPL

growth in 2020 experienced by BPR Nusantara Bona Pasogit 10 individually is

also experienced by industry. The trend of NPL growth in 2020 for the BPR

industry is at a value of 8.34% (business finance, 2020) and from the second

quarter 2020 report,

|

Table 6 Return

on Asset (ROA) January 2020 – December 2020 period (in percentage) |

|||||||||||||

|

Jan |

Feb |

Mar |

April |

May |

June |

July |

Aug |

Sept |

Oct |

Nov |

Dec |

||

|

ROA |

5.82 |

6.02 |

5.96 |

5.65 |

5.17 |

4.89 |

4.78 |

4.57 |

4.5 |

4.28 |

4.14 |

3.96 |

|

|

Source: Monthly financial report 2020 |

|||||||||||||

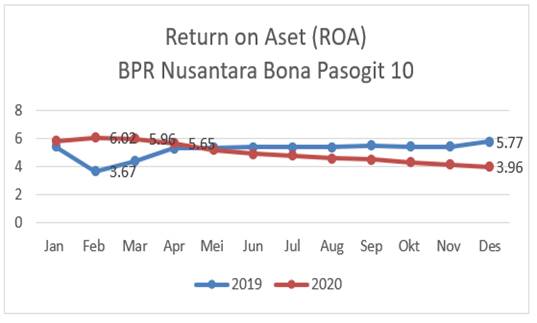

Return on Assets which is a

healthy provision is above 1.5% according to the banking performance report

issued by the Financial Services Authority to be said to be good. The trend in

2020 shows good performance while maintaining the achievement above 1.5% even

though this trend is a declining trend starting with the beginning of 2020 at

5.82% and in December 2020 it fell to 3.96%

Covid-19 impact analysis, the trend of the company's ability to

provide returns on asset utilization during 2020 has decreased

|

|

|

Figure 6 Return on Asset Source: Monthly financial reports for 2019

and 2020 |

In the early 2020 period, the

highest ROA achievement was in February with a value of 6.02% but coinciding

with the start of the COVID-19 pandemic in March, it was seen that the ROA

decreased to 5.96% in March 2020, this continued in April, dropping back to

5.65%. The downward trend continued until the ROA was achieved in December of

3.96%. On the other hand, in 2019, the trend was relatively insignificant ROA

growth. The lowest value of ROA in February was 3.67% but this continued to

improve and at the end of 2019 it was 5.77%. The decline in ROA value is in

line with the weakening of the banking industry due to the Covid-19 pandemic.

|

Table 7 Summary

of the analysis of the financial health of BPR Nusantara Bona Pasogit 10 as a

result of Covid-19 |

||||

|

No |

Indicator |

2019(average) |

2020(average) |

Conclusion |

|

1 |

Earning Asset Quality (KAP) |

2.39 |

4.05 |

Performance drop |

|

2 |

Operating Expenses Operating Income

(BOPO) |

78.5 |

78.17 |

Stable |

|

3 |

Cash Ratio (CR) |

12.37 |

22.98 |

Performance Improvement |

|

4 |

Loan to Deposit Ratio (LDR) |

71.22 |

60.19 |

Performance Drop |

|

5 |

Non-Performing Loans (NPL) |

4.3 |

6.17 |

Performance drop |

|

6 |

Return on Assets (ROA) |

5.18 |

4.97 |

Performance drop |

Based on the conclusions of

the six indicators of the financial health of the Nusantara Rural Credit Bank

Bona Pasogit 10, several ratios that are closely related to lending to the

public show a decline in performance, this is the impact of the macroeconomic

slowdown, which then has an impact on several industries due to the COVID-19

pandemic. The policy to reduce the spread of the covid virus is social

restrictions in all aspects, this restriction causes the performance of the

majority of the industrial sector to decline, due to this decline in profits,

one of the strategies taken by the company to stay afloat is a reduction in

salary or worse, termination of employment.

3.2. STRATEGIC STEPS FOR THE BONA PASOGIT 10 RURAL BANK DURING THE COVID-19 PANDEMIC PERIOD

1) Develop a credit restructuring policy as a result of the

spread of Covid-19 BPR Nusantara Bona Pasogit 10

Bank Perkreditan Rakyat Nusantara Bona Pasogit 10 as one of the micro community fund management institutions supports Government policies related to economic conditions that require special attention, especially to maintain the sustainability and liquidity of the Company. By referring to the Financial Services Authority Regulation Number 11/POJK.03/2020 regarding the National economic stimulus as a counter cyclical policy as a result of the spread of Coronaviris Disease 2019, the Board of Directors of BPR Nusantara Bona Pasogit 10 compiled a policy guideline for credit restructuring as a result of the spread of coronavirus disease 2019 (Covid-19).) which was later ratified by the Board of Commissioners on March 23, 2020. Decree of the Board of Directors Number 29/SKDIR/BPR-NBP10/III/2020 concerning Credit Restructuring Policies and Procedures for the Impact of the Spread of Covid-19.

Specifically, this guideline is a form of risk mitigation that regulates:

· Sectors Affected by Coronavirus -19 Economic sectors affected by the spread of Coronavirus -19 both directly and indirectly include the tourism, transportation, hotel, trade, processing, agriculture, and mining sectors.

· Criteria for debtors affected by Coronavirus -19 Debtors who are determined to be affected by Coronavirus -19 and can be given credit restructuring are:

1) Debtors who have daily income or daily income workers; or

2) Debtors who earn monthly but do not work for a while (lay off without receiving income) or are subject to termination of employment (PHK) (eg workers/factory employees); or

3) A debtor who is sick and is categorized as a Patient under Supervision (PDP) so that he cannot run his business or cannot work as usual; or

4) Debtors who are already positive are constrained by Coronavirus -19 so they cannot run their business or cannot work as usual.

· Credit restructuring policy for debtors affected by Coronavirus -19 Several technical implementations of credit restructuring at BPR Nusantara Bona Pasogit 10, namely:

5) Instalment Payment Delay,

· Delay in payment of principal instalments, namely providing a postponement of the obligation to pay the principal instalments for a certain period of time and such delay may be granted for a maximum period of 6 (six) months. Furthermore, the total amount of the deferred principal instalment payment obligations is charged on a prorate basis on the remaining credit term.

· Postponement of interest instalment payments, namely providing a postponement of the obligation to pay interest instalments for a certain period of time and the postponement is granted for a maximum period of 6 (six) months ahead. Furthermore, the total amount of the deferred interest instalment payment obligations is charged on a prorate basis on the remaining credit period.

· Postponement of payment of principal and interest instalments, namely providing a postponement of the obligation to pay instalments of principal and interest for a certain period of time and the postponement is granted for a maximum period of 6 (six) months ahead. Furthermore, the total amount of the outstanding principal and interest instalment payments is charged on a pro-rata basis over the remaining loan term.

6) Reduction of principal and/or interest instalments

· Reduction of the number of principal instalments, namely providing a certain amount of reduction from the amount of the obligation to pay the previous principal instalment, the reduction is given for a certain period of time with a maximum period of 6 months. Furthermore, the accumulated amount of the deduction is added to the remaining principal debt that will be paid by the debtor during the remaining credit period.

· Reduction of the number of interest instalments, namely providing a certain amount of reduction from the amount of the obligation to pay the previous interest instalments, the reduction is given for a certain period of time with a maximum period of 6 months. Furthermore, the accumulated amount of the deduction is added to the remaining interest payable to be paid.

· Reduction of the amount of principal and interest instalments, namely providing a certain amount of reduction from the total amount of the previous principal and interest instalment payments, the reduction is given for a certain period of time with a maximum period of 6 months. Furthermore, the accumulated amount of the deduction is added to the remaining principal and interest to be paid by the debtor for the remaining term of the credit.

7) Asset quality determination policy for debtors affected by Coronavirus -19 The quality of the restructured credit is determined to be current since the restructuring is carried out until the restructuring period ends and a maximum of until March 31, 2021, and the subsequent determination of credit quality follows the provisions of the applicable collectability determination. If the impact of the spread of the Coronavirus -19 in Indonesia has not ended, with certain considerations it is possible to restructure the restructuring as intended by taking into account the maximum period in accordance with the provisions or up to a period determined later through the Financial Services Authority (OJK).

Policy for granting credit/providing new funds to debtors affected by Coronavirus -19

Reporting debtors affected by Coronavirus -19

· BPR submits reports for positions at the end of April 2020, June 2020, September 2020, December 2020, and March 2021 offline to OJK on Debtors who receive special treatment as stipulated in the Regulation of the Financial Services Authority of the Republic of Indonesia Number 11/POJK.03/2020 regarding the National Economic Stimulus as a Countercyclical Policy for the Spread of Corona Virus Disease 19

· BPR submits reports with a deadline for submitting reports, namely the end of the following month after the position of the reporting month.

· If the deadline for submitting reports falls on Saturdays, Sundays and/or national holidays. The report is submitted on the next working day.

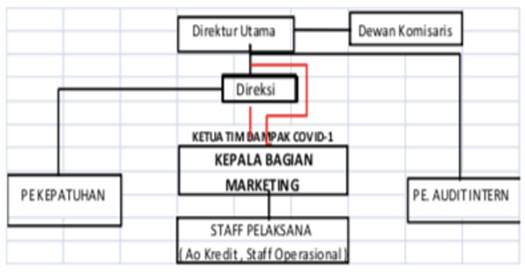

3.3. FORMING A TEAM AND TASK FORCE FOR HANDLING COVID-19

BPR Nusantara Bona Pasogit 10

realizes that the development of COVID-19 that has affected debtors and the

entire entity requires a management team that specifically focuses on handling

and resolving debtors affected by COVID-19. The Board of Directors through the

Board of Directors Decree Number 63/SKDIR/BPR-NBP10/III/2020 regarding the

handling and settlement of debtors affected by COVID-19 to further regulate the

responsible officers and teams.

1) Formation of a team to handle and resolve the impact of COVID-19

· BPR assigns duties and responsibilities to the Head of Marketing as Head of the Team for Handling and Settling the Impact of Covid-19

· In carrying out his duties, he is assisted by credit AO and operational staff (credit admin, accounting, IT) throughout the office network.

2) Organizational structure

· In carrying out his duties, the Head of the Covid-19 Impact Team reports and is responsible to the Board of Directors

· All credit staff throughout the office network are required to report to the Head of the Covid-19 Impact Team on Debtors at the head office and branch offices.

· Internal supervision ensures that the handling and settlement of debtors affected by Covid-19 is in accordance with the provisions and regulations

· In order for the directives and provisions to be implemented properly, the BPR must have an adequate working mechanism and the said work mechanism is documented by each work unit. The working mechanism also takes into account the existing provisions.

· The appointment of an Officer responsible for Debtors affected by Covid-19 is stated in the Decree of the Board of Directors.

|

|

|

Figure 7 Organizational

Structure of the Covid-19 Impact Debtor Handling Team |

3) Duties of the Head of the Covid-19 Impact Management Team

· Monitoring, evaluating, and reporting performance related to Debtors affected by Covid-19

· Report to the Board of Directors regarding Debtors affected by Covid-19 and provide recommendations for handling and settlement of Debtors' credit affected by Covid-19

· Propose restructuring of debtors affected by Covid-19 to the President Director and the Restructuring Committee.

· Prepare and submit reports on Debtors affected by Covid-19 and the anticipations that have been made to the Financial Services Authority through the Board of Directors.

4) Duties of Implementing and Implementing Staff for Handling and Settlement of Debtors Affected by Covid-19

· Receive and record statements and requests for restructuring, additional credit by Debtors affected by Covid-19

· Coordinate to conduct surveys and re-analysis of requests for restructuring and addition of debtor credit affected by Covid-19

· Coordinate with the head of the Team for handling and resolving Debuturs affected by Covid-19

· Propose restructuring of debtors affected by Covid-19 to the Restructuring Committee

· Report to the Team Leader on the development of handling and settlement of Debtors affected by Covid-19 both in writing and verbally/unwritten.

5) Restructuring Procedure

· The request for restructuring is carried out by filling out a form that can be obtained at the BPR office or downloaded from the BPR website or through the BPR officer.

· In filling out the loan restructuring application form, the debtor must explain the extent of the impact of the spread of Covid-19

· The loan restructuring application form is analysed by the Covid-19 Impact Handling Team which has been formed by the BPR

· The BPR conducts a survey of the Debtor's submission in accordance with the procedures regarding the survey applicable to the BPR

· The Covid-19 Impact handling team determines the form of restructuring that will be carried out and makes recommendations based on the results of the analysis to credit breaker

· BPR informs the results of the restructuring decision to the Debtor

· If the BPR approves the restructuring, then the credit documentation is carried out in accordance with the credit SOP and the debtor is not subject to administrative fees, but the credit addendum PK is still legalized by a notary.

The head of the Covid-19 Impact handling team has duties including monitoring, evaluating all debtors affected by COVID-19. One form of monitoring and evaluation of the Covid-19 handling team and the Board of Directors that has not been carried out is by selecting alternative strategies if there is a failure in the Covid-19 handling strategy that depends on the policies of the financial services authority or in other words BPR Nusantara Bona Pasogit 10 has not have a policy

3.4. RESTRUCTURING DEBTOR LOANS AFFECTED BY COVID-19

With reference to some of the

rules below "

1)

POJK Number

11/POJK.03/2020 concerning the national economic stimulus as a countercyclical

policy due to the impact of the spread of COVID-19

2)

POJK Number

48/POJK.02/2020 concerning changes to the regulations of the financial services

authority number 11/POJK.03/2020 concerning the national economic stimulus as a

countercyclical policy due to the impact of the spread of COVID-19

3)

Decree of the Board of

Directors Number 29/SKDIR/BPR-NBP10/III/2020 regarding policies and procedures

for credit restructuring due to the spread of COVID-19

3.5. REPORTING TO REGULATION

POJK Number 48/POJK.02/2020

concerning changes to financial services authority regulations number

11/POJK.03/2020 concerning the national economic stimulus as a countercyclical

policy from the impact of the spread of COVID-19 regulates the obligation of BPRs

to report restructuring credit stimulation and reports on credit stimulus

recapitulation. or financing. In particular, in article 8 paragraph Ambarwati

and Abundanti (2018) Banks that determine the quality of credit or financing and/or other

provision of funds are only based on the accuracy of payment of principal

and/or interest or margin/profit sharing/ujrah as referred to in article 3

paragraph Ambarwati

and Abundanti (2018) or Article 4 paragraph Ambarwati

and Abundanti (2018) submits a credit or financing stimulus report and/or other provision of

funds assessed based on the accuracy of payments. Furthermore, in Article 8

paragraph Ananto

and Ferdawati (2020), the bank conducting credit or financing restructuring as referred to

in Article 5 paragraph Ambarwati

and Abundanti (2018) submits:

·

Report on credit

stimulus or restructuring financing; and

·

Report on credit

stimulus recapitulation or restructuring financing

Article 8 paragraph Dangnga

and Haeruddin (2018), Banks report restructured loans or

financing as referred to in article 5 paragraph Ambarwati

and Abundanti (2018) in the financial information service system by adding information on

Covid-19. BPR Nusantara Bona Pasogit 10 is fully committed to this obligation

through monthly reports, one of which is contained in the Letter of the Board

of Directors No B-234/BPR NBP 10/XI/2021 addressed to the financial services

authority for regional office 5, Northern Sumatra.

4. CONCLUSIONS AND RECOMMENDATIONS

4.1. CONCLUSIONS

1) The financial health and profitability ratios at the

Nusantara Credit Bank Bona Pasogit 10 prior to the Covid 19 period were in a

good trend as indicated by the achievement of ratios that were within healthy

indicators and in general the financial health and profitability ratios at the

Nusantara Credit Bank Bona Pasogit 10 during the Covid 19 period experienced

performance decline throughout 2020 compared to 2019.

2) The strategic steps taken by the Nusantara Credit Bank Bona

Pasogit 10 during the Covid 19 period were: (a). Develop an internal policy for

restructuring debtors affected by COVID-19 (b). Establish a team and task force

for handling debtors affected by covid-19 (c). Restructuring debtors affected

by COVID-19 and (d). Reporting to the Financial Services Authority as mandated

in POJK 48/POJK.02/2020

4.2. RECOMMENDATION

1) The Bona Pasogit 10 Dolok Sanggul Rural Bank is

industrially affected by the covid-19 pandemic, the restructuring policy that

was issued on March 23, 2020, requires periodic reviews at least once every 3

months, this is done to anticipate changes in regulations and accommodate

changes in the ability of BPR Bona Pasogit customers 10.

2) BPR Bona Pasogit 10 Risk Management is deemed necessary to

periodically and measurably, at least once a month to update the risk register

of all units to ensure that any changes that have a direct impact can be

mitigated early.

3) In this momentum, BPR Nusantara Bona Pasogit 10, deemed it necessary to conduct an initial study using a Business Contingency Plan, Business Recovery Plan or Business Continuity Planning approach as an initial methodology for business continuity as a form of readiness to anticipate future outbreaks or disasters.

REFERENCES

Ambarwati & Abundanti. (2018). Effect of Capital Adequacy Ratio, Non Performing Loan, Loan to Deposit Ratio on Return on Assets. E-journal of Unud Management, Vol 7, No.5. DOI : Retrieved from https://doi.org/10.24843/EJMUNUD.2018.v07.i05.p04

Ananto and Ferdawati. (2020). The health level of Islamic Rural Banks in the midst of the Covid-19 Pandemic (Case Study at BPRS Al-Makmur Payakumbuh). Journal of Financial and Business Accounting Vol 13, no.1

Andrianto. (2020). Credit Management Theory and Concepts for Commercial Banks. Qiara Media Publisher

Dangnga & Haeruddin. (2018). Banking Financial Performance : Efforts to Create a Sound Banking System. Science Park Library

Dervish. (2019). Asset and liability management. Trust Media Publishing. Yogyakarta

Echdar Saban. (2017). Management and Business Research Methods. Bogor : Ghalia Indonesia

Estu, Ahmad Zulkarnain. (2017). Analysis of the Influence of CAR, NPL, BOPO and LDR on Profitability of State-Owned Enterprises in the Banking Sector in Indonesia. Bilancia, Vol 1. No.2, ISSN 2549-5704

Fitriani. (2020). Comparative Analysis of the Financial Performance of Islamic Commercial Banks during the Covid-19 Pandemic. Journal of Islamic Accounting and Business, Vol 2. No. 2

Ilhami and Husni Thamrin. (2021). Analysis of the Impact of Covid 19 on the Financial Performance of Islamic Banking in Indonesia. Tabarru Journal ; Islamic Banking and Finance Vol.4 no.1 Retrieved from https://doi.org/10.25299/jtb.2021.vol4(1).6068

Kholiq and Rizqi Rahmawati. (2020). The Impact of the Implementation of Financing Restructuring on the Liquidity of Islamic Banks in the Covid-19 Pandemic Situation. Jurnal el Barka : Journal of Islamic Economics and Business Vol.3 No. 2 Retrieved from https://doi.org/10.21154/elbarka.v3i2.2472

Kirigia, JM, & Muthuri, RNDK (2020). The Fiscal Value of Human Lives Lost From Coronavirus Disease (COVID-19) in China. BMC Research Notes, 13(1), 1-5. Retrieved from https://doi.org/10.1186/s13104-020-05044-y

Kusuma, Suhadak and Arifin. (2013). Analysis of the Effect of Profitability and Growth Rate on Capital Structure and Firm Value (Study on Real Estate and Property Companies listed on the Indonesia Stock Exchange en 2007-2011). Profit : Journal of Business Administration. Vol.7 No.2

Nasution, Dito Aditia Darma ; Erlina ; Young Iskandar. (2020). Impact of the COVID-19 Pandemic on the Indonesian Economy. Journal of Benefit 5 (2). 212-224. Retrieved from https://doi.org/10.22216/jbe.v5i2.5313

Notalin, Nonie Afrianty and Asnanini (2021). The Impact of Covid-19 on the Financial Performance Efficiency of Islamic Commercial Banks in Indonesia uses the Data Envelopment Analysis (DEA) Approach. Scientific Journal of Accounting, Management & Islamic Economics Vol.04 No.1 Retrieved from https://doi.org/10.47191/jefms/v4-i11-09

Rustan (2020). Effect of ALMA on Financial Performance and Entity Value in Banks listed on the IDX. Scientific Journal of Asian Business and Economics. Vol 14. No 2. 84-96

Sofia. (2021). Performance of BPR and BPRS during the Covid 19 Pandemic. Proceedings of the 2nd National Seminar on ADPI serving the Country of Community Service in the New Normal Era

Sugiyono (2015). Combination Research Methods (Mix Methods). Bandung:Alphabet.

Sukendri (2021). Liquidity and Capital of Government-Owned Banks before and during the Pandemic. Vol 9, No.1.DOI : Retrieved from https://doi.org/10.29303/distribution.v9i1.161

Supeno and Hendarsih. (2020). Credit Performance on BPR Profitability during the Covid-19 Pandemic. Champion's Familiar Journal

Tiwu. (2020). The Effect of the Covid-19 Pandemic on the NPL of Rural Banks in Indonesia. Journal of Accounting : Transparency and Accountability Vol.8 No. 2 Retrieved from https://doi.org/10.35508/jak.v8i2.2869

Wahyudi. (2020). Analysis of the influence of CAR, NPF, FDR, BOPO and Inflation on the profitability of Islamic Banking in Indonesia: Study of the Covid-19 Pandemic Period.DOI: Retrieved from https://doi.org/10.21580/at.v12i1.6093

Yusriani. (2019). Effect of CAR, NPL, BOPO, and LDR on Profitability of State-owned Commercial Banks (Persero) on the Indonesia Stock Exchange. Research Journal Edition XXV. Vol 4. No 002

Zahara. (2013). Analysis of the Soundness of Rural Banks (BPR) Using the Camel Method (Case Study of Three BPRs in West Sumatra). Journal of Accounting and Management, 8(2), 61-75.

Zeuspita & Yadnya. (2019). Effect of CAR, NPL, DER and LAR on ROA at Commercial Banks on the Indonesia Stock Exchange. E-Journal of Unud Management, Vol.8, No.12.DOI : Retrieved from https://doi.org/10.24843/EJMUNUD.2019.v08.i12.p25

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© IJETMR 2014-2022. All Rights Reserved.