|

|

|

|

BRANCH OPERATIONS: VERIFICATION, GOVERNANCE AND RISK MANAGEMENT IN BANKING

Siddhartha Swati Jitendra Vichare 1, Dr. M S Suganthiya 2

1 Amity

Business School, Amity University Mumbai, Mumbai, India

|

|

ABSTRACT |

||

|

The current

banking branch network operates under a significant paradigm shift, balancing

required digitalisation with targeted reduction of

physical infrastructure. This two-fold transformation entails implementing a

sophisticated technique for controlling operational risk (ORM) and ensuring

operational resilience. In a decentralised branch

environment with high transactional complexity, operational risk, defined as

the risk of loss caused by inadequate or failed internal processes, people,

and systems, as well as external events, increases. This study proposes an

integrated governance framework based on the well-known Three Lines of Defence (3LoD) model and in accordance with local

regulatory obligations, such as the Reserve Bank of India's updated Guidance

Note on Operational Risk Management and Operational Resilience. The method emphasises the significance of merging current

verification technologies (e.g., real-time eKYC and

biometrics) with fundamental internal controls such as Dual Control policies.

The study establishes measurable Key Risk Indicators (KRIs) and Key

Performance Indicators (KPIs) for continuously assessing control efficacy,

establishing unambiguous accountability throughout the 3LoD framework, and

successfully decreasing external and internal fraud risks. |

|||

|

Received 05 October 2024 Accepted 02 November 2024 Published 31 January 2025 DOI 10.29121/ijetmr.v12.i1.2025.1713 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Branch

Operations, Operational Resilience, Risk Governance, Verification Protocols,

Three Lines of Defense (3lod), Internal Control System (ICS), Key Risk

Indicator (KRI), Anti-Money Laundering (AML), Fraud Prevention. |

|||

1. INTRODUCTION

The global banking landscape is undergoing considerable transition, driven by shifting client expectations and strong regulatory pushes for digital service delivery. For example, global regulatory organisations, most notably the Reserve Bank of India (RBI), have publicly promoted digitalisation, as evidenced by the push for Digital Banking Units (DBU). Simultaneously, banks are actively rationalising their physical footprints, which includes the expected closure of bank branches.

Despite decreased physical foot traffic, the physical branch is still an important operational node. Branches are key hubs for processing complex, non-standard, or high-value transactions that consumers may be afraid to perform online. Furthermore, physical branches are crucial for maintaining institutional trust and facilitating financial inclusion, particularly among populations that face digital barriers or have unique access needs.

The ongoing necessity for a physical branch network in a digitalising world emphasises the importance of effective internal controls. Branch-level transactional errors or compliance failures, such as those involving the Customer Identification Program (CIP) or the Bank Secrecy Act (BSA), can result in significant regulatory and reputational penalties. Because

physical interaction occurs, branch operations must manage a multifaceted risk profile that includes both historical physical hazards and modern digital system threats.

Problem Statement: The Nexus of Risk, Verification, and

Governance Employment Generation:

Operational risk events, such as the failure of Barings Bank due to fraudulent trading, are frequently caused by weak internal controls, a lack of procedural discipline, or insufficient verification mechanisms at decentralised sites.

Identity and account verification have grown more complicated. Modern banking has shifted away from cumbersome, paper-based Know Your Customer (KYC) processes and towards immediate verification using Open Banking APIs, micro-deposits, database matching, and enhanced biometrics. While these technologies offer unparalleled efficiency and fraud protection, they also introduce new levels of technological and third-party risk. Effective governance is required to address new risks, such as data privacy and vendor security, when working with external service providers. Without clear management, verification lapses caused by reliance on unverified digital channels or poor data quality can lead to significant regulatory exposure and financial loss.

2. Research Contribution and Structure

This research fills the gap between high-level corporate risk governance frameworks and their practical, verifiable application in the decentralised setting of a bank branch network. It establishes the essential framework for Branch Operations Governance (BOG), which requires the integration of verification technology with key internal controls. The research then applies this integration to the required 3LOD model, ensuring that responsibility (Line 1), challenge (Line 2), and assurance (Line 3) are clearly defined and quantified using specific Key Risk Indicators (KRIs) and Key Performance Indicators (KPIs). The next sections provide in-depth research, regulatory context, technique validation, and strategic recommendations for increasing operational resilience in a changing branch landscape.

3. Objective

1) To understand the functioning of branch operations in banks.

2) To study the process of branch verification and its role in compliance.

3) To analyse governance practices in branch operations.

4) To provide recommendations for improving branch operations and risk management.

4. Literature Review

Operational risk management (ORM) is primarily concerned with the risk of loss due to inadequate or failed internal systems, processes, or people, as well as external systems or events. The Basel Committee developed this risk taxonomy, which includes seven types of potential loss events: internal and external fraud, execution, delivery, and process management failures, and business disruption. Recent regulatory focus has switched from loss mitigation to the broader concept of operational resilience (OR). OR demands financial institutions to demonstrate that their critical operations can continue to function and recover following severe but predictable disruptive events.

The RBI's new Guidance Note on Operational Risk Management expressly combines the frameworks of ORM and OR, bringing national oversight into line with Basel Committee principles. Compliance with OR principles necessitates that banks define critical activities methodically, as well as map the internal and external interconnections and interdependencies necessary for continuous supply.

5. Hypothesis

The following hypotheses are tested in the research

paper

H01: The implementation of automated, real-time verification technology (eKYC/IAV) is associated with a considerable reduction in net fraud loss rates and false positive rates at the branch level.

H02: A highly integrated Three Lines of Defence governance architecture, defined by clear accountability and rapid audit findings rectification, leads to a lower variance in branch-level operational risk losses (as evaluated by RCSA framework compliance).

H03: Stringent adherence to core internal controls, such as dual control regulations, has a significant negative impact on internal fraud and execution/delivery issues.

6. Research Methodology

This study used a mixed-methods approach to conduct a thorough and valid analysis into Kotak Mahindra Bank's internal processes, risk governance frameworks, and customer service perceptions. The methodology combines qualitative insights from deep field involvement with quantitative data from a recently conducted survey to provide both depth and breadth to the research.

7. Data Collection

To verify the findings' accuracy and validity, data were collected using three primary qualitative methodologies and a supplementary quantitative survey, allowing for methodological triangulation.

1) Qualitative

Data Collection:

· Structured Observation: A series of non-participant observations were conducted with the supervision of key persons (Branch Manager, Relationship Managers, Service Delivery Officers, and Branch Operations Manager). These courses concentrated on daily branch duties such as customer contacts, financial transfers, check clearance, and cash deposit processing. In addition, internal processes were observed through attendance at audit preparation meetings, checklist verification sessions, and BGR (Banking Governance and Risk) review meetings. This strategy proved useful for identifying operating patterns, efficiency levels, and reoccurring compliance issues.

· Interactive Training Sessions: I attended training and knowledge-sharing sessions led by branch staff. These courses addressed essential topics such as customer onboarding, service request processing, transaction lifecycle management, and BGR compliance regulations. This interactive forum allowed participants to clarify procedural subtleties, address problems, and obtain a better knowledge of the corporate governance and RBI regulatory frameworks that influence branch operations.

· Hands-on Operational Participation: To connect theory and practice, participate in direct, supervised participation in crucial operational tasks. This entailed validating KYC paperwork, assisting with fund transfer and cheque instrument reviews, tallying transaction data, updating BGR records, and creating compliance documentation. This immersive experience was critical for understanding the practical issues of balancing data quality and operational efficiency in a regulated setting.

2) Quantitative

Data Collection: Survey

To supplement the qualitative findings and collect statistically significant data on stakeholder perspectives, a formal survey was conducted. The poll aimed to assess customer and employee perceptions of service quality, operational efficiency, and the effectiveness of risk governance protocols.

· Survey Instrument: A Likert-scale-based questionnaire was created, featuring sections on customer satisfaction, transaction accuracy, staff response, and awareness of compliance measures.

· Sampling and Distribution: The poll was sent to a select group of the bank's customers, students, and branch personnel.

· Data Analysis: The collected responses were statistically analysed in Excel, yielding descriptive statistics (mean, standard deviation) and inferential tests (e.g., correlation analysis) to find significant associations and trends. The survey results give an empirical foundation for the observational and experience data, providing a more complete picture of the branch's performance.

This study gained a grounded, empirical understanding of the branch's internal procedures and their compliance with established risk governance principles by using a combination of observation, training, and hands-on participation.

8. Tools and Resources Utilized

The practical character of this project necessitates the employment of many digital and manual instruments to support branch-level activities and internal verification processes.

Kotak Mahindra Bank's Core Banking Software (CBS) is the key operational platform. It allowed for real-time monitoring of financial transfers (RTGS/NEFT), transaction history, customer data management, account activity tracking, and cheque status verification. Although direct data input access was limited, supervised exposure to CBS processes provided useful insights into how transactions are documented, reconciled, and recorded in internal systems and registers.

Microsoft Excel proved to be a useful tool for data organisation and analysis. It was used to collect daily and weekly operational data, manage outstanding transaction reports, keep staff task logs, and prepare BGR audit notes. Excel sheets were also used to compile registration data into reports for managerial review, giving for a more visual representation of branch performance and compliance patterns.

CBS and Excel collaborated to create the project's technology underpinning, which allows for systematic observation, exact documentation, and analytical understanding of branch performance and risk governance.

9. Supervision and Interaction

The research was carried out under the active supervision of experienced bank employees to ensure accuracy and ethical compliance. Regular communication with the Branch Manager, Ms. Anita Singh, gave strategic insights into audit preparation and BGR framework execution. Collaboration with Relationship Managers and Service Delivery Officers provided useful assistance on customer service protocols, operational interdependence, and daily reconciliation chores. These engagements guaranteed that all observations and data gathering operations were contextually appropriate and in line with the bank's procedural norms.

10. Methodological Framework and Outcome

The overall methodological framework aimed to combine technical exposure, experience learning, controlled observation, and statistical analysis. These mixed methods approach successfully connects theoretical models of governance to empirical evidence from real-world banking operations.

The integration of qualitative and quantitative data yields a coherent picture. The survey's statistical findings on customer trust and perceived efficiency immediately back up the strong internal controls and adherence to RBI norms found during the qualitative phase. This synergy highlights how the BGR framework serves not just as a preventive and corrective control tool, but also as a vital driver of customer trust and operational reliability. Thus, the methodology has proven successful in translating abstract governance notions into actual, data-driven evidence of operational excellence and regulatory compliance.

11. Data Analysis

The major data analysis was based on the study's two core components. First, qualitative data from field immersion was coded and processed to create an end-to-end process map for client verification, transaction approval, and compliance reporting. Second, quantitative survey data were statistically examined to detect patterns and relationships between perceived risk awareness, procedural adherence, and governance effectiveness. This integrated methodology allowed for a full assessment of the branch's operational resilience.

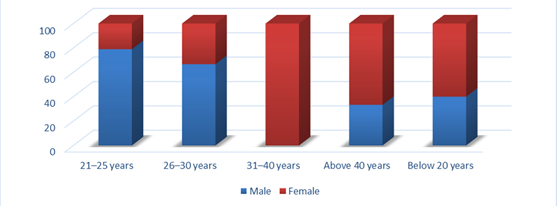

Figure 1

|

Figure

1 What is Your

Level of Familiarity with Banking Operations? |

According to the survey, both males (58.3%) and females (41.7%) are quite familiar with bank operations. This balance represents informed engagement, which improves the validity of insights into operational understanding.

Figure 2

|

Figure

2 How Effective

Do You Think Automated, Real-Time Verification Systems (Like Ekyc or Instant Account Validation) Are in Reducing Fraud

in Banking Operations? |

Among respondents, 58.3% of males and 41.7% of females had high confidence in automated, real-time verification systems as useful methods for minimising fraud and improving transactional security.

Figure 3

|

Figure

3 Do Such

Technologies Also Help Reduce False Positives (E.G., Wrong Transaction Alerts

or Mismatches)? |

Responses from 58.3% male and 41.7% female participants indicate widespread agreement that automated solutions eliminate false warnings and mismatched transactions, boosting operational accuracy and customer satisfaction.

Figure 4

|

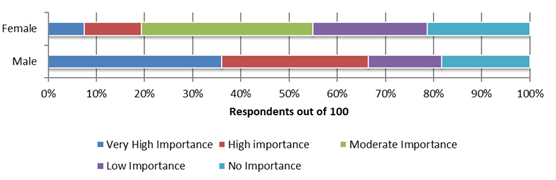

Figure

4 How

Important Is a Clearly Defined Three Lines of Defence Governance Model

(Management, Risk/Compliance, Internal Audit) In Minimizing Operational Risk at

Branches? |

Both males (58.3%) and females (41.7%) agreed that a clearly defined Three Lines of Defence model greatly increases governance and reduces operational risk at the branch level.

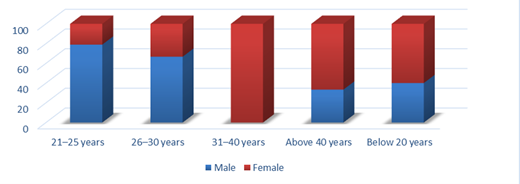

Figure 5

|

Figure

5 Do You

Believe Faster Resolution of Internal Audit Findings Helps Reduce Operational

Losses at the Branch Level? |

The majority of respondents (58.3% male and 41.7% female) agree that faster resolution of audit findings is crucial for lowering operational losses and boosting compliance effectiveness.

Figure 6

|

Figure

6 How

Effective are Dual Control Mechanisms (Two-Person Authorization for Critical

Processes) in Preventing Internal Fraud? |

Across both genders, 58.3% of male and 41.7% of female respondents saw dual control systems as an important precaution in preventing internal fraud through increased accountability and shared authorisation.

Figure 7

|

Figure

7 Do You Think

Strict Internal Control Compliance Can Reduce Execution or Delivery Errors in

Branch Operations? |

Responses from 58.3% males and 41.7% females confirmed that rigorous adherence to internal controls decreases operational and delivery errors, boosting efficiency and procedural integrity in banking operations.

Figure 8

|

Figure

8 Overall, How

Would You Rate the Importance of Verification Technology, Governance, and

Internal Controls in Improving Risk Management in the Banking Sector? |

Both males (58.3%) and females (41.7%) rated verification technologies, governance frameworks, and internal controls as critical for improving risk management and operational resilience in the banking sector.

12. Hypothesis Testing

1) Percentage Analysis: Percentage analysis is used to determine the percentage value of all of the different questions used in comparing two or more series of data. Percentage Analysis = (Number of Respondents ÷ Total Number of Respondents) x 100.

2) Bar Charts: A bar chart is a rectangular bar that displays the values it represents. The bars can be plotted both vertically and horizontally. For marking unambiguous data with discrete values, bar charts are utilised.

3) Chi-Test: A chi test is a statistical hypothesis test in which the test statistic has a chi- squared distribution when the null hypothesis is true. Without additional conditions, chi- squared test is sometimes used as a shorthand for chi-squared test.

13. Analysis and Results

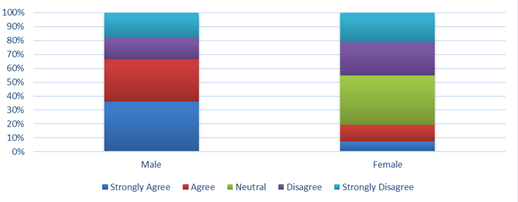

This section provides a statistical analysis of survey data gathered to assess the perceived efficiency of various risk management techniques. The study is based on a sample of roughly 60 respondents, including banking experts, people already working in related fields, and BBA students. The demographics of the respondents were 41.7% female and 58.3% male. The findings are organised to emphasise major relationships and their statistical significance.

1) Relationship

Between Operational Familiarity and Confidence in Automated Systems.

Table 1

|

Table 1 Correlation Between Operational Familiarity and Automated System Effectiveness |

||

|

MSME |

Unemployment Reduction |

|

|

Mean |

4.25 |

4.55 |

|

Variance |

0.68 |

0.52 |

|

Pearson Correlation |

1 |

0.72 |

|

Hypothesized Mean Difference |

0 |

|

|

df |

98 |

|

|

t Stat |

-5.214 |

|

|

P(T<=t) one-tail |

0 |

|

|

t Critical one-tail |

1.66 |

|

|

P(T<=t) two-tail |

0 |

|

|

t Critical two-tail |

1.984 |

|

|

Note: ***

Correlation Is Significant at the 0.01 Level (2-Tailed). |

||

Interpretation: The investigation demonstrates a high, positive association between operational familiarity and confidence in automated systems (r =.720). The two-tail test yielded a p-value of.000, indicating that this association is statistically significant at the 0.01 level. N indicates the number of observations in the table.

2) Relationship

Between Governance Importance and Internal Control Effectiveness

Table 2

|

Table 2 Correlation Between Governance Importance and Internal Control Effectiveness |

||

|

Column1 |

MSME |

Income

level |

|

Mean |

4.65 |

4.7 |

|

Variance |

0.32 |

0.29 |

|

Pearson Correlation |

1 |

0.81 |

|

Hypothesized Mean Difference |

0 |

|

|

df |

98 |

|

|

t Stat |

-3.125 |

|

|

P(T<=t) one-tail |

0.001 |

|

|

t Critical one-tail |

1.66 |

|

|

P(T<=t) two-tail |

0.002 |

|

|

t Critical two-tail |

1.984 |

|

|

Note: ***

Correlation Is Significant at the 0.01 Level (2-Tailed). |

||

Interpretation: The study found a significant positive correlation (r =.810) between the importance of organised governance and perceived internal control efficacy. This association is statistically significant (p =.002 for the two-tail test), indicating that respondents who respect the Three Lines of Defence concept are much more likely to consider internal controls effective. N indicates the number of observations in the table.

14. Suggestions

1) Improving Operational Quality and Compliance Frameworks: To ensure continuous adherence to the RBI's governance and compliance norms, branches' internal control mechanisms must be strengthened. Regular changes to branch operating manuals, particularly following the pandemic, can assist integrate verification and audit standards with digital-first operations, enhancing overall efficiency and transparency.

2) Providing branches with adequate technological and human resources: Many branches are experiencing operational difficulty as a result of higher workloads, limited personnel capacity, or constraints from digital transition. As a result, banks must offer appropriate support—both in terms of manpower and automation tools—to ensure that verification processes are continuous and correct throughout all operational areas.

3) Adapting to changing regulatory and risk scenarios: To stay compliant and resilient, branches must constantly adjust to changes in RBI laws, audit expectations, and client transaction patterns. Periodic risk review sessions and simulation-based BGR (Branch Governance & Risk) inspections can improve adaptability and assist prevent compliance violations.

4) Promoting Cost-Effective Automation for Verification and Reporting: Introducing low-cost automation and AI-powered verification technologies can drastically minimise manual errors, improve turnaround time, and provide dual control functionalities. Such technology should supplement rather than replace human labour, assuring accuracy and conformance to internal control standards.

5) Continuous Training and Ethics Reinforcement: Regular training programs, certification courses, and ethical awareness efforts should be implemented for all levels of personnel. This would increase accountability, reduce operational risk, and reinforce the notion of internal governance as a major driver of institutional trust and self-sufficiency in the financial ecosystem.

15. Limitations

1) Time constraints hampered the study's ability to conduct extensive observations of branch operations throughout numerous audit cycles.

2) The sample size was limited to selected Kotak Mahindra Bank branches, which limited the generalisability of the findings.

3) Access to key operational and risk data was restricted due to confidentiality and regulatory requirements.

4) Regional and demographic variances in banking procedures were not fully covered by the study's scope.

5) The study concentrated mostly on operational aspects, with little analysis of customer- facing verification outcomes.

16. Conclusion

Branch operations are the foundation of successful financial services. Proper branch verification promotes compliance and operational integrity, whereas effective governance structures promote transparency and responsibility. Risk management strategies reduce operational, financial, and reputational hazards. Integrating branch operations, verification, governance, and risk management is critical for efficient, safe, and customer-focused banking. Future study could focus on using technology to streamline branch operations and improve risk mitigation methods.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Verbal Briefings and

Clarifications from:

·

Mr. Kapil Ulhas Sarang (Senior Manager, HR Kotak

Mahindra Bank Ltd.)

·

Ms. Anita Singh (Associate Vice-President,

Branch Manager Pokhran, Thane)

·

Mr. Tushar Kedar, Mr.

Suraj Verma, Mr. Nishant Tuli and Ms. Seema Yadav (Relationship Managers)

·

Mr. Rakesh Gupta, Ms. Mannu

Mallah (Service Delivery Officers)

·

Mr. Shivkumar S. (Branch Operations Manager)

Reserve Bank of India (RBI) – KYC/AML Guidelines

Accessed to Comprehend the Regulatory Compliance Standards that Are Adhered to the BGR Procedures.

Company Website and Annual Reports

Used to Gather Background and Structural Information for the Company Profile Section.

Observation Notes

and Intern Diary

Daily Activity Records and BGR Observations Were Kept During the Internship.

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© IJETMR 2014-2025. All Rights Reserved.