|

|

|

|

A STUDY ON THE AWARENESS OF MUTUAL FUNDS AMONG RETAIL INVESTORS

Shrushti Gambhire 1, Dr. M.S. Suganthiya 2

1 BBA

(Banking and Finance), Amity Business School, Amity University Mumbai, Mumbai,

India

2 Assistant

Professor, Amity Business School, Amity University Mumbai, Mumbai, India

|

|

ABSTRACT |

||

|

This research is basic on awareness of mutual funds is examined in this review, with a focus on how demographic, informational, and psychological aspects influence involvement and understanding. The goal of this Research to identify the variables influencing mutual fund investing decisions and preferences over retail investors. Additionally, this research seeks to learn more about the reasons why people choose not to invest in mutual funds. The results will assist mutual fund companies in determining what has to be improved and in enhancing their marketing tactics. It will assist MF companies in developing novel and inventive products that align with investor preferences. A mutual fund is a trust-based financial

pool that invests the savings of several investors who have similar financial

objectives, such as dividend income and capital growth. The funds gathered in

this way are subsequently used to purchase capital market assets including

shares, debentures, and foreign exchange. Investors make investments and get

units based on the unit value, which is known as the net assets value, or

NAV. |

|||

|

Received 05 April 2025 Accepted 02 May 2025 Published 30 June 2025 DOI 10.29121/ijetmr.v12.i6.2025.1701 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Mutual Funds, Investors, Retail |

|||

1. INTRODUCTION

A financial instrument that consists of a collection of funds from numerous investors with the intention of investing in securities like stocks, bonds, money market instruments, and other comparable assets.

The impressive growth in the Indian Mutual fund industry in recent years can largely be attributed to various factors such as rising household savings, comprehensive regulatory framework, favourable tax policies, and introduction of several new products, investor education campaign and role of distributors

Individuals who purchase and sell securities for their own individual accounts rather than on behalf of a major institution are known as retail investors. They usually make smaller investments and access markets such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs) through online trading platforms or brokers. They have personal objectives, like accumulating wealth or saving for retirement.

Retail investors seeking professional management, diversification, and relatively lower entry barriers compared to direct stock investments, mutual funds have become one of the most favoured investment choices. However, the general public's understanding of mutual funds in India remains inconsistent, despite the growth of the industry.

To understand investor’s perception and preference a survey has been conducted among 100 people from city. This research paper will focus on the variables affecting retail investors' choices of funds and schemes. Additionally, it will assist the mutual fund company in implementing fresh and creative marketing strategies

2. STATEMENT OF THE PROBLEM

Even though mutual funds are a useful investment tool that provides diversification and expert management, many people are still ignorant of or have a poor grasp of how they operate, their advantages, and the risks involved. Low participation and poor investment decisions result from this lack of knowledge, underscoring the need for research to evaluate current awareness levels and create plans to enhance financial literacy and informed investing. This knowledge gap restricts investor participation, causes people to make poor decisions, and slows the mutual fund market's expansion.

3. LITERATURE REVIEW

Numerous studies on various aspects of mutual funds have been carried out both in India and overseas.

Madhusudhan (1996) carried out his research to determine the factors influencing mutual fund investment decisions and to assess the direction of mutual funds in investors. The research

Faisal and Ahuja (2022) assessed the cause-and-effect relationship between mutual fund investment decisions and fund family, fund size, fund type, portfolio and scheme type, fund manager risk, fund performance history, liquidity factors, and current market conditions.

The study "An empirical study of performance evaluation of selected ELSS mutual fund schemes" by J. Lilly and Dr. Anasuya was published in the International Journal of

LIC NOMURA MF GROWTH and dividend schemes have the highest return and are risk-borne when compared to other schemes, according to a scientific study (2014) that evaluated the performance of 49 chosen tax-saving elss schemes using the Sharpe ratio, Treynor ratio, Sortino ratio, and Jensen's alpha measure.

Mohanty (2022) examined mutual funds' shortcomings. These include the unavailability of custom schemes, the lack of cost control, the inability to guarantee returns, the difficulty of managing a sizable corpus, the fact that return volatility is dependent on market conditions, which are prone to frequent market volatility, and the fact that most investment periods are medium-term to long-term, with higher expected returns. Market mutual funds are a short-term investment plan with fewer instruments and a low return.

Sudhakar and Sasi Kumar (2022), the majority of growth-oriented mutual funds have outperformed benchmark indicators in terms of return. It is anticipated that growth-oriented mutual funds will provide the benefits of selectivity, market timing, and diversification.

4. Research Objectives

· To evaluate current mutual fund awareness levels across various demographic segments.

· To analyse the variables influencing awareness, such as age, income, education, and media habits.

· To determine and examine the awareness about mutual funds, their preferences, and the obstacles.

· To provide suggestions for enhancing mutual fund literacy by incorporating knowledge from secondary sources.

5. Research Methodology

RESEARCH DESIGN: Descriptive research is used to get accurate and comprehensive information. Surveys and fact-finding are components of descriptive research inquiries of various types.

RESEARCH APPROACH: The approach adopted in this study is survey approach.

RESEARCH INSTRUMENT: The research instrument used in the study is Questionnaire method.The questionnaire consists of both open end and close end questions.

DATA SOURCE: The study made use of primary data.Primary data is information gathered from samples taken for research purposes.The original data was gathered by using a structured questionnaire

SAMPLING AREA: Navi Mumbai

SAMPLE SIZE: The sample size of the study is limited to 100 people.

6. LIMITATIONS OF THE STUDY

6.1. Sample size of the study was limited to 100 only.

The study was not carried out over a long period of time that took market fluctuations into account. The state of the market has a big impact on the investors' preferences and purchasing habits. Such circumstances cannot be included in the study

7. FINDINGS

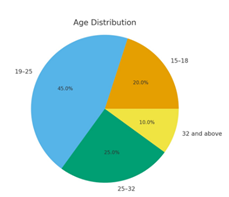

Age Distribution

Figure 1

|

Figure 1 Age Distribution |

INTERPRETATION

The age distribution describes how the respondents are spread out in different age groups:

15–18 years old: 20%

A small percentage of young responders shows early interest either in financial or survey-related subjects.

19–25 years old: 35%

This could suggest that young adults are the majority participants since this group is the largest. Because this age group may still be in the learning or early career stages, there might be differences in financial behavior and awareness.

25–32 years old: 25%

a sizeable portion starting steady careers. This generation usually starts considering long-term financial planning and investments.

20% of those over 32

an older and more financially focused group with clearer financial goals, probably with more investment and savings experience.

The largest proportion of the respondents is between the ages of 19 and 25 years, meaning that this study is largely representative of young adults. Nevertheless, the older age brackets included do ensure diversity in financial awareness and behaviour.

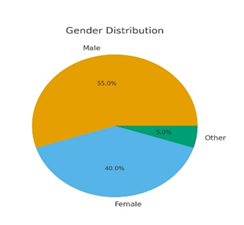

Gender Distribution

Figure 2

|

Figure 2 Gender

Distribution |

INTERPRETATION

The gender distribution represents the dispersion of participation across different identities:

Male: 55%

Males are more than half of the respondents, which may indicate that they were more available or involved during data collection.

Female: 40%

A strong female respondent representation adds important diversity and balance to the findings of the study.

Other: 5%

A tiny but important part of the respondents reported themselves as non-traditional. Their participation lends nuance and inclusiveness to the survey's results..

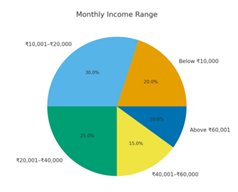

Monthly Income Range

Figure 3

|

Figure 3 Monthly

Income |

INTERPRETATION

The majority of the respondents, as per the survey, fall in the category of ₹10,001–₹20,000, indicating a young or early-earning population. A moderate fraction of responses falls in the range of ₹20,001 to ₹40,000, showing increased financial capacity. The negligible number above ₹60,000 suggests that high-income earners are underrepresented. The sample generally leans toward people with modest incomes, which could have implications for the kind of financial products they prefer, the tolerance level for risk, and investment behavior.

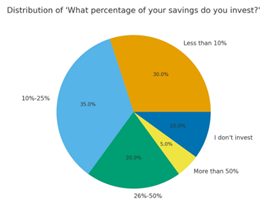

What percentage of your savings do you invest?

Figure 4

|

Figure 4 Percentage of

Savings do you Invest |

INTERPRETATION

From the data, the majority are only investing a small fraction of their savings. Those that invest below 10% are almost equal in number to the largest group, which invests between 10 - 25%. Very few have invested over half of their savings, while a smaller fraction is between 26 and 50 % of total savings.

10% of the respondents do not invest at all, which might indicate a lack of financial literacy or reluctance to use investment products.

Overall, this trend demonstrates that people are cautious investors; the majority of respondents prefer to invest only a small fraction of their savings. It might be because of financial constraints, low risk tolerance, or lack of proper investment knowledge.

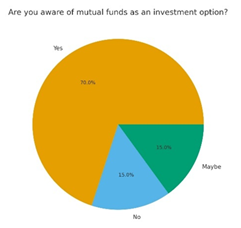

Are you aware of mutual funds as an investment option?

Figure 5

|

Figure 5 Awareness of

Mutual Funds |

INTERPRETATION

70% of the respondents reported being aware of mutual funds. It would, therefore, appear that the basic level of awareness amongst the population is indeed high. Only 15% were found to be ignorant, while another 15% were not sure; this, while there is knowledge, still shows that some people need exposure or more accurate information. By and large, most of the respondents recognize mutual funds as one of the known modes of investment.

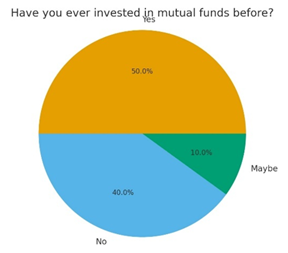

Have you ever invested in mutual funds before ?

Figure 6

|

Figure 6 invested in

mutual funds |

INTERPRETATION

Answers show a contradictory impression. On one hand, half of the participants have invested already in mutual funds, meaning that quite a big number of people are getting used to such investment. On the other hand, quite a big 40% have never made an investment, showing either reluctance or poor knowledge of how mutual funds work. And ten percent are still indecisive, which could mean a lack of knowledge or variables in decision-making regarding finance. Overall, interest is there, but non-investors still have a lot of room to gain confidence and understanding.

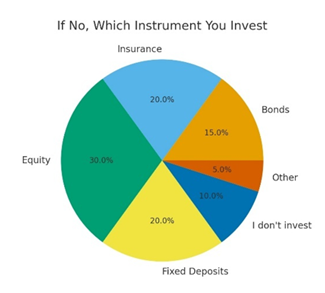

If no then, which instrument you invest

Figure 7

|

Figure 7 Which

Instruments you Invest |

INTERPRETATION

Among those who do not invest in mutual funds, equity comes out to be the most favored substitute, gaining the attention of 30 percent of the respondents. Next in popularity are insurance and fixed deposits, each selected by 20 percent, reflecting that a large number of people still prefer more conventional and low-risk alternatives. Bonds take 15 percent, while the remaining small chunk, about 5 percent, invests in other instruments. Interestingly, as many as 10 percent do not invest at all, which may indicate either caution with money or simply lack of awareness. Overall, the pattern shows a mix of risk-taking and safety-seeking behavior among non-mutual-fund investors.

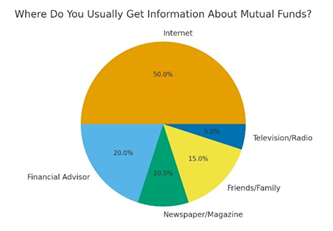

Where do you usually get information about mutual

funds?

Figure 8

|

Figure 8 Information of Mutual Funds |

INTERPRETATION

The dependence on digital sources is therefore highest for mutual fund learning, with the internet being the most important channel in this area. Traditional sources, such as financial advisers, newspapers, and magazines, remain in use but are relied on by fewer people. Friends and family also contribute to investment awareness, which shows personal networks are influential. The least-used channels are television and radio, which suggests investors today prefer information that can be accessed easily and quickly rather than through older forms of media. Overall, the trend is one of online learning and peer recommendations.

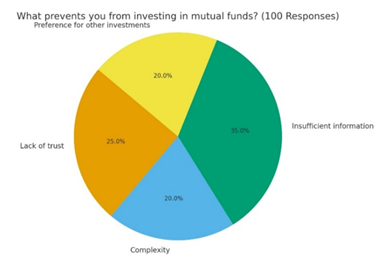

What prevents

you from investing in mutual funds?

Figure 9

|

Figure 9 Prevent you from

Investing in Mutual Funds |

INTERPRETATION

Primarily, the reasons which keep people away from investment in mutual funds are a lack of confidence in the investment, intricacy of the mutual fund product, lack of adequate information to make a decision, and preference for more familiar alternatives like fixed deposits or real estate. These barriers underline the imperative need for better awareness, simpler communication, and the building of trust for mutual fund participation.

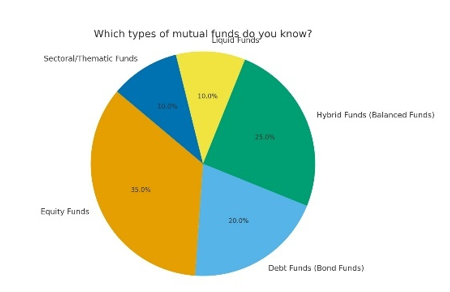

Which types of mutual funds do you know?

Figure 10

|

Figure 10 Types of

Mutual Funds |

35% of respondents, equity funds are the most well-known kind of mutual fund. Debt (bond) funds at 20% and hybrid (balanced) funds at 25% come next. Only 10% of participants were familiar with liquid funds and sectoral/thematic funds. This suggests that while specialized or short-term options are less well-known, investors are more aware of conventional and heavily advertised mutual fund categories.

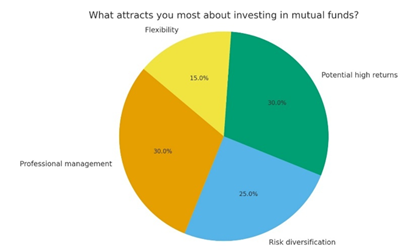

What attracts you most about investing in mutual funds?

Figure 11

|

Figure 11 Attracts you

Most About Investing in Mutual Funds |

INTERPRETATION

According to 30% of respondents, professional management and the possibility of large returns are the main reasons why investors choose mutual funds. 25% are drawn to risk diversification, and 15% are drawn to flexibility. This suggests that investors value spreading risk and having flexible investment options in addition to financial expertise and potential returns.

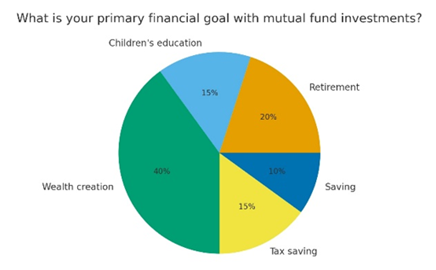

What is your primary financial goal with mutual fund

investments?

Figure 12

|

Figure 12 Primary Financial Goal with

Mutual Fund Investments |

INTERPRETATION

Wealth creation is the main financial objective for 40% of respondents who invest in mutual funds. 20% goes toward retirement planning, 15% goes toward general savings and children's education, and 10% goes toward tax savings. This suggests that while long-term growth is still the primary consideration, respondents also take particular future needs and tax advantages into account when selecting mutual fund investments.

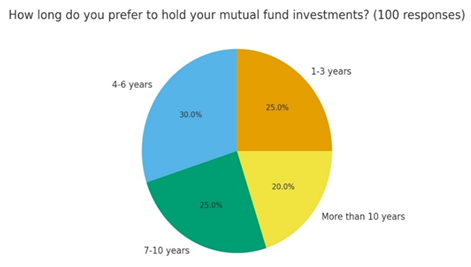

How long do you prefer to hold your mutual fund

investments?

Figure 13

|

Figure 13 Mutual Fund Investments

Preference to Hold |

INTERPRETATION

Respondents’ investment horizons in mutual funds are fairly evenly distributed. About 25% prefer a short-term holding of 1–3 years, another 25% aim for a medium-term period of 7–10 years, while 20% opt for 4–6 years and 20% for more than 10 years. This suggests that investors have diverse timeframes, reflecting a mix of short-term goals and long-term wealth planning.

8. SUGGESTIONS

1) Factors

Preventing Mutual Fund Investment

People hold back from investing in mutual funds mainly because they find them hard to understand or don’t have enough reliable information. Some struggle with trust, while others stick to familiar investment options like FDs or real estate. These concerns show that many potential investors still need clearer guidance and confidence-building.

2) Awareness

of Mutual Fund Categories

Most respondents recognize common mutual fund types such as equity, hybrid, and debt funds. However, awareness drops when it comes to liquid funds and sectoral or thematic options. This suggests that while investors understand the basics, exposure to more specialized categories is still low.

3) Key

Attractions of Mutual Funds

What draws investors most is the comfort of having professional fund managers handle their money and the chance to earn higher returns. Diversifying risk also appeals to many, while a smaller group appreciates the flexibility mutual funds offer. This shows that both expertise and growth potential play a major role in shaping investor interest.

4) Primary

Investment Goals

Wealth creation stands out as the main reason people invest in mutual funds. Many also use them for retirement planning, children’s education, or general saving. Tax-saving is a motive for a smaller group. Overall, mutual funds are seen as tools for long-term financial progress.

5) Preferred

Holding Period

Investors’ preferred holding periods vary widely. Some want shorter commitments of 1–3 years, while others are comfortable staying invested for 7–10 years or even longer. This blend of short and long horizons shows that mutual funds appeal to different financial plans and priorities.

9. CONCLUSION

Although retail investors are becoming more aware of mutual funds, their knowledge is still limited and primarily concentrated on well-known categories like equity, hybrid, and debt funds, according to this study, which was shaped by the questionnaire responses. When they come across liquid, sectoral, or thematic funds, understanding declines, suggesting that awareness is still superficial. The results also highlight important obstacles that drive many investors toward conventional choices like fixed deposits and real estate, such as low trust, perceived complexity, and unclear information. At the same time, investors are drawn to mutual funds by powerful incentives like expert management, the possibility of greater returns, diversification, and flexibility; the most popular financial objective is wealth creation.

According to the study's overall findings, investors are interested in mutual funds but lack confidence because of their limited knowledge. Mutual funds can become a more crucial component of long-term financial planning for a greater number of retail investors by enhancing financial literacy, streamlining communication, and building trust.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

All Commerce Journal. (n.d.). Investor Awareness and Behavioural Trends in Mutual Fund Investments.

BSSS Publications. (n.d.). A Study on Perception of Investors Towards Mutual Funds.

Educational Journal. (n.d.). A Study on Individual Investors’ Awareness on Mutual Funds.

European Electronic Law and Economics Journal (EELET). (n.d.). Evaluating Investor Awareness and its Impact on Mutual Fund Investments.

International Research Journal of Modern Engineering and Technology Science (IRJMETS). (n.d.). A Study on Awareness and Preference for Mutual Funds in Ahmedabad.

JISEM Journal. (n.d.). A study on Awareness of ESG Mutual Funds Among Retail Investors.

Management Paper. (n.d.). Awareness and Behaviour of Retail Investors Towards Mutual Funds.

Sathyabama Institute of Science and Technology. (n.d.). A Study on Investor Awareness about Investment of Mutual Funds.

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© IJETMR 2014-2025. All Rights Reserved.