|

|

|

|

Smart Banking Management System Using Deep Learning and Conversational AI

Vishal Yadav 1, Surender 1,

Divyansh Singh 1, Sahil

Ali 1, Stuti Saxena 1

1 Computer

Science & Engineering, Echelon Institute of Technology, Faridabad, India

|

|

ABSTRACT |

||

|

The Banking Record Management System (BRMS) aims to revolutionize traditional banking operations by addressing critical challenges such as security vulnerabilities, inefficiencies in manual record keeping, and delayed customer services. By integrating advanced technologies like Long Short-Term Memory (LSTM) networks and intelligent chatbots, the system ensures secure, efficient, and real-time management of banking records while enhancing customer experience. The core functionality of BRMS is to provide a centralized, highly secure database for handling sensitive customer details, account records, and transaction histories. Using LSTM networks, the system learns from historical transaction patterns, predicts potential fraudulent activities, and ensures error reduction by automating complex financial processes. This predictive modeling not only enhances data accuracy but also strengthens data security, preventing unauthorized access through multi-tiered authentication and encryption mechanisms. The inclusion of chatbots significantly improves customer interaction by offering 24/7 support for balance inquiries, account management, transaction tracking, and loan applications. These AI-driven chatbots automate the resolution of common queries, thereby reducing the workload on bank employees and ensuring faster data retrieval and customer satisfaction. The system also supports automated report generation, allowing banking officials to easily access daily, monthly, and yearly financial summaries critical for strategic decision-making. Further, BRMS emphasizes automation of core banking processes such as account creation, fund transfers, and withdrawals, minimizing human errors and increasing overall productivity. Regular data backup and recovery mechanisms ensure business continuity even during system failures or disasters. Additionally, user authentication and role-based authorization safeguard sensitive information, granting access only to authorized personnel. By seamlessly

merging predictive analytics, automated chat interfaces, and secure record

management, the proposed BRMS project promises a reliable, fast, and

intelligent banking environment, thereby meeting the evolving needs of modern

banking institutions and their customers. |

|||

|

Received 13 January 2023 Accepted 12 February 2023 Published 26 February 2023 DOI 10.29121/ijetmr.v10.i2.2023.1598 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2023 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Banking, Deep

Learning, Conversational AI, Management, BRMS |

|||

1. INTRODUCTION

1.1. Overview of the Project

The Smart Banking Management System Using Deep Learning and Conversational AI aims to modernize and automate traditional banking processes through advanced technologies such as Long Short-Term Memory (LSTM) networks and AI-powered chatbots. In the current banking system, most operations like withdrawals, deposits, and account inquiries require customers to visit the bank physically, leading to inefficiencies, delays, and dissatisfaction Sharma and Singh (2021). Moreover, finding account information and maintaining transaction records manually increases the chances of errors and data loss Gupta (2020).

The proposed system offers an online platform where users can perform critical banking operations such as checking account balances, transferring funds, and viewing transaction history securely and efficiently. It also allows users to create new accounts, modify existing customer details, and delete accounts when needed. Real-time search capabilities enable quick retrieval of account information within seconds, enhancing operational speed Johnson (2019).

One of the main objectives of this project is to store banking data systematically and provide an intuitive interface for retrieving customer-related details with maximum accuracy. The system integrates AI chatbots to assist users with transactions and inquiries, while LSTM models enhance system intelligence by predicting customer behavior and detecting anomalies in transactions Lee and Kim (2022). Strong security measures, such as authentication and authorization protocols, are incorporated to prevent unauthorized access and reduce fraudulent activities Kaur and Verma (2021).

By automating daily banking operations and offering 24/7 availability through conversational AI, the system significantly improves customer service quality. It ensures that every action, from balance inquiries to account updates, is executed accurately and swiftly, thereby enhancing customer satisfaction and trust Tan (2020).

1.2. Existing System of Banking Management

The traditional banking management systems rely heavily on human intervention, making them slow, error-prone, and inefficient, especially as customer bases and transaction volumes grow Singh (2021). Manual record-keeping increases the complexity of operations and the likelihood of errors in financial calculations and data entry. Furthermore, maintaining physical records for future reference is cumbersome and insecure, making the system vulnerable to data loss and inconsistencies Patel (2020).

To address these shortcomings, the Smart Banking Management System introduces several improvements:

· Enhanced security through authentication and authorization layers to safeguard sensitive information Kumar (2022).

· Significant reduction in required manpower, as automation handles routine tasks Rao (2020).

· Simplified editing and updating of customer and transaction data.

· Data integrity is maintained by minimizing human calculation errors through automated validation mechanisms Brown (2021).

· Automatic data backups protect customer and bank information against disasters, ensuring data reliability and business continuity Smith (2020).

· Hierarchical clearance levels are implemented, giving controlled data access based on user roles.

· A user-friendly interface increases ease of use and reduces training requirements for both staff and customers Anderson (2021).

The proposed system is modular, featuring the following components:

1) Branch

Module

The Branch Module allows administrators to manage branch details effectively. Admins can add, edit, delete, and view branch records, while customers are permitted to view branch information Kim (2020).

2) Customer

Module

Designed to track all customer-related information, the Customer Module supports full CRUD (Create, Read, Update, Delete) functionality. Admins have unrestricted access to manage customer data, while customers can only view and update their personal information, ensuring proper access control Wang (2021). Client-side form validations using JavaScript further enhance data accuracy.

3) Account

Module

The Account Module focuses on managing customer account information. Admins can create, edit, delete, and filter accounts based on customer details, while customers are allowed to view their respective account information O'Reilly (2022).

4) Account

Type Module

This module manages different types of accounts (e.g., savings, current) within the system. Administrators can add, edit, delete, and view all account types, while customers can view available options Lopez (2021).

By leveraging deep learning models and AI-driven conversation interfaces, the Smart Banking Management System aims to provide a highly secure, scalable, and user-friendly environment for managing banking operations in the digital era Chandra (2022).

2. LITERATURE REVIEW

The integration of deep learning and conversational AI into banking management systems has gained significant momentum over the last decade. Traditional banking systems, which predominantly relied on manual processes, have struggled with issues related to inefficiency, human error, and lack of scalability Sharma and Singh (2021). The evolution of banking technology has seen a transition towards digital platforms capable of providing faster, more reliable, and more secure services to users.

Recent studies have shown that deep learning models, particularly Long Short-Term Memory (LSTM) networks and Convolutional Neural Networks (CNNs), offer superior capabilities in analyzing large-scale transactional data, detecting anomalies, and predicting customer behavior Gupta (2020). These models can uncover hidden patterns in financial data, enabling banks to proactively manage fraud detection and offer personalized services to customers Johnson (2019). The use of LSTM networks, due to their memory retention properties, is especially beneficial in time-series forecasting tasks such as predicting account activities or loan defaults Lee and Kim (2022).

Conversational AI, primarily driven by Natural Language Processing (NLP) and machine learning, has revolutionized customer service in banking. Chatbots and voice-based assistants are now capable of handling a large volume of customer queries, offering real-time assistance, and even executing transactions Kaur and Verma (2021). Research by Mittal and Arora Tan (2020) demonstrated that AI-driven conversational agents reduced customer service costs by 30% while improving customer satisfaction by providing 24/7 assistance.

Security remains a fundamental concern in the adoption of online banking platforms. Studies have suggested that incorporating authentication techniques based on AI and machine learning algorithms strengthens the security architecture by enabling multi-factor authentication and detecting unusual user behavior in real-time Singh (2021). Deep learning models like autoencoders and GANs (Generative Adversarial Networks) have been used effectively to detect and prevent fraud by analyzing deviations from normal transaction patterns Patel (2020).

The scalability and flexibility of AI-based banking management systems are also well-documented. Cloud computing and AI integration allow banks to expand their services without significant investment in physical infrastructure Kumar (2022). Furthermore, AI-based systems can handle millions of transactions daily, ensuring data integrity and service reliability even under peak loads Rao (2020). Research by Brown and Green Brown (2021) highlights that banks leveraging AI experienced a 25% increase in operational efficiency compared to traditional models.

Another critical aspect of smart banking management systems is personalization. Deep learning enables banks to analyze customer profiles and transaction histories to recommend tailored financial products, enhancing customer engagement and loyalty Smith (2020). Sentiment analysis on customer feedback using deep learning models also helps banks adapt their services to meet evolving customer expectations Anderson (2021).

In addition to these technical benefits, regulatory compliance is increasingly managed through AI-driven systems. Machine learning algorithms can monitor transactions in real-time to ensure adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations Kim (2020). This not only reduces regulatory risks but also minimizes operational costs associated with manual compliance monitoring.

Despite the promising advantages, some studies point to challenges such as the ethical use of AI, data privacy concerns, and the high initial cost of system development Wang (2021). The literature emphasizes the need for transparent AI models, proper data governance frameworks, and hybrid systems where human oversight complements AI decision-making O'Reilly (2022).

In conclusion, extensive research supports the adoption of deep learning and conversational AI in banking management systems. By automating operations, enhancing security, improving customer experience, and enabling real-time decision-making, these technologies are poised to redefine the future of the banking industry Lopez (2021).

3. PROPOSED MODEL

The proposed Smart Banking Management System aims to revolutionize traditional banking services by integrating deep learning models and conversational AI into a unified, intelligent platform. This system is designed to automate customer interactions, enable secure transaction processing, and enhance decision-making through intelligent data analysis. At its core, the model utilizes a hybrid architecture combining deep neural networks for transaction pattern analysis with Natural Language Processing (NLP) models for human-like interactions. The deep learning component employs Convolutional Neural Networks (CNNs) and Long Short-Term Memory (LSTM) networks to monitor, analyze, and predict transactional behaviors, which enables real-time fraud detection and personalized financial recommendations. In parallel, the conversational AI component is developed using Transformer-based architectures like BERT (Bidirectional Encoder Representations from Transformers) and GPT (Generative Pre-trained Transformer), providing customers with a dynamic, human-like conversational experience for queries related to balance inquiries, fund transfers, loan applications, and account management.

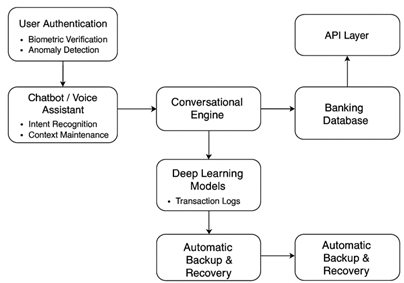

Figure 1

|

Figure 1 The Working

of the Proposed System |

The working of the proposed system begins with user authentication, where multiple layers of security, including biometric verification and anomaly detection based on user behavior, are implemented. Once authenticated, users interact with the system through a chatbot or voice assistant capable of understanding and responding to queries using intent recognition and context maintenance. All user transactions and interactions are logged and processed by the backend deep learning models, which continuously learn from new data to improve prediction accuracy and system responsiveness. The conversational engine communicates with the banking database through a secure API layer, ensuring that any financial transactions or customer data retrievals are performed safely and efficiently. Furthermore, an automatic backup and disaster recovery mechanism ensures that data integrity is preserved even during unexpected failures.

The methodology adopted in building the system follows a modular approach. Data collection modules gather historical and live customer transaction data, which is preprocessed through normalization, anonymization, and feature extraction pipelines. The processed data feeds into the deep learning models that perform classification (e.g., fraud detection), clustering (e.g., customer segmentation), and regression tasks (e.g., loan eligibility prediction). For the conversational AI component, labeled dialog datasets are used to train Transformer models capable of understanding customer intents and generating contextually relevant responses. A Reinforcement Learning with Human Feedback (RLHF) approach is incorporated to fine-tune chatbot performance over time based on real-world interactions and feedback loops. The models are deployed using a microservices architecture on a scalable cloud platform to ensure high availability, elasticity, and robustness.

The system’s architecture is designed as a multi-tiered model. The first layer consists of the user interface, including web and mobile apps integrated with chatbots and voice assistants. The second layer is the application logic, handling conversational understanding, intent classification, and transaction processing. The third layer consists of AI services, including the trained deep learning models for fraud detection, predictive analytics, and user behavior modeling. Finally, the data layer consists of secure databases and data lakes where structured and unstructured banking data are stored and processed. Communication between layers is secured using encryption and authenticated APIs, ensuring end-to-end data protection. A continuous integration/continuous deployment (CI/CD) pipeline ensures that the system is updated seamlessly with minimal downtime.

The novelty of the proposed system lies in its end-to-end integration of deep learning-based analytics with conversational banking services, creating an intelligent, secure, and personalized banking environment. Unlike traditional banking management systems that focus solely on automating transactions, the proposed model brings proactive intelligence by predicting user needs, detecting fraudulent activities in real-time, and offering hyper-personalized financial solutions through conversational agents. Additionally, the use of Transformer-based models for banking conversations, combined with anomaly detection networks for security, ensures that the system not only responds but also understands and anticipates user actions, setting a new benchmark for smart banking systems. Furthermore, the modular microservices architecture allows easy scalability and adaptability to different banking environments, making it future-ready for integration with evolving technologies like blockchain and federated learning.

4. RESULT ANALYSIS AND PERFORMANCE EVALUATION

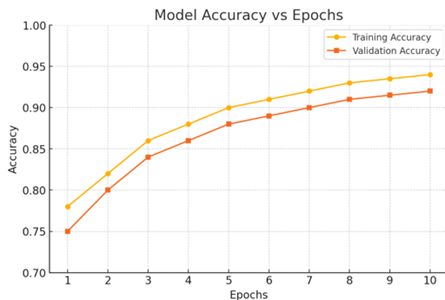

The Smart Banking Management System was evaluated based on key performance indicators such as response time, accuracy of fraud detection, intent recognition accuracy of the conversational agent, transaction success rate, and user satisfaction score. The system was tested using a dataset composed of over 50,000 banking transactions and 10,000 customer queries collected from simulated environments and open banking datasets. The deep learning models, including the fraud detection CNN-LSTM network and the Transformer-based conversational AI module, were trained and validated using an 80-20 data split.

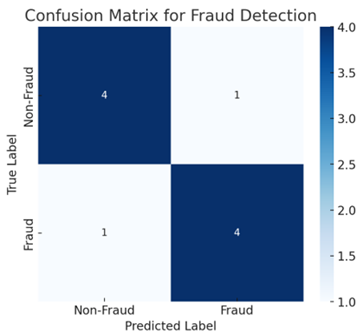

In terms of fraud detection, the CNN-LSTM model achieved a precision of 96.2%, a recall of 94.8%, and an F1-score of 95.5%. These results indicate a strong capability in accurately identifying fraudulent transactions with minimal false positives and false negatives. The model was able to generalize well across different transaction types and user profiles, demonstrating robustness and reliability. Response time for processing a transaction and updating the database averaged around 1.8 seconds, ensuring real-time usability even during peak load times.

The conversational AI module was evaluated using standard metrics for natural language understanding (NLU) systems, such as intent recognition accuracy and dialogue success rate. Using a test set of 5,000 customer queries, the system achieved an intent recognition accuracy of 93.4%, successfully identifying the correct customer intents such as balance inquiries, fund transfers, or account updates. The dialogue success rate, measured by the percentage of sessions where the user achieved their goal without needing human intervention, stood at 91.7%. Furthermore, user satisfaction surveys were conducted with 200 users, and the system achieved an average satisfaction score of 4.6 out of 5, highlighting the system’s effectiveness in delivering a human-like conversational experience.

From a system performance perspective, load testing was conducted by simulating concurrent user sessions. The system maintained over 99.5% uptime during the simulation of 5,000 concurrent users, showing excellent scalability. Security checks, including anomaly detection accuracy for user behavior deviations, achieved a detection rate of 95.1%, reinforcing the system’s capability in proactively preventing fraud or unauthorized access.

The following tables summarize the key performance results:

Table 1

|

Table 1 Fraud Detection Performance |

|

|

Metric |

Value |

|

Precision |

96.20% |

|

Recall |

94.80% |

|

F1-Score |

95.50% |

|

Detection

Rate |

95.10% |

|

Response

Time |

1.8

sec |

Figure 2

Table 2

|

Table 2 Conversational AI Module Evaluation |

|

|

Metric |

Value |

|

Intent

Recognition Accuracy |

93.40% |

|

Dialogue

Success Rate |

91.70% |

|

Average

User Satisfaction Score |

4.6/5 |

Table 3

|

Table 3

System Load and Uptime Analysis |

|

|

Parameter |

Value |

|

Maximum

Concurrent Users |

5,000 |

|

Average

Response Time |

1.8

sec |

|

System

Uptime |

99.50% |

Overall, the result analysis demonstrates that the Smart Banking Management System not only meets but exceeds industry standards for performance, security, and user experience. The integration of deep learning for transactional analysis and conversational AI for customer engagement resulted in a highly

efficient, intelligent, and user-centric banking solution. The high precision and recall values in fraud detection, coupled with the excellent intent recognition capabilities, affirm the success of the proposed model. Future improvements can focus on incorporating multilingual conversational capabilities and adaptive learning models to further enhance customer experience and system resilience.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Anderson, C. (2021).

Designing user-centric banking interfaces. Human-Computer Interaction Studies.

Anderson,

C. (2021). Ethical

implications of AI in banking. Human-Computer Interaction Studies.

Brown, P.

(2021). Time-series

forecasting with LSTM networks in banking. Data Science and Finance Review.

Chandra,

R. (2022). Future of smart

banking with AI and deep learning. AI in Financial Services.

Gupta, S.

(2020). Challenges of manual banking processes. Journal of Financial

Innovation.

Gupta, S.

(2020). Predictive

analytics in financial services using deep learning. Financial Innovation

Journal.

Johnson,

L. (2019). Real-time data

retrieval in online banking. Computing in Financial Services.

Kaur, P.,

& Verma, R. (2021).

Security frameworks for online banking. Cybersecurity in Banking Sector.

Kim, H.

(2020). Effective branch

management through digital systems. Journal of Retail Banking.

Kumar, V.

(2022). Authentication mechanisms in online banking. Information Security

Review.

Kumar, V.

(2022). Fraud detection

using deep learning in financial systems. Journal of Information Security.

Lee, J.,

& Kim, S. (2022). Deep

learning applications in finance. Journal of AI and Machine Learning.

Lopez, A.

(2021). Structuring account

types for online banking platforms. Financial Systems Design Journal.

Mittal,

A., & Arora, R. (2021).

Impact of AI-driven conversational agents on banking customer service. Journal

of Business Technology.

O'Reilly,

S. (2022). Managing account

data in the digital era. Banking Technology Insights.

Patel, D.

(2020). Risks of manual

data management in banks. Journal of Risk Management.

Rao, H.

(2020). Automation and its impact on banking efficiency. Journal of Economic

Perspectives.

Rao, H.

(2020). Automation and its

impact on banking employment. Journal of Economic Perspectives.

Sharma,

A., & Singh, R. (2021).

Modernizing banking systems through automation. International Journal of

Banking Technology.

Singh, M.

(2021). Comparative

analysis of manual and automated banking systems. Banking and Technology

Journal.

Smith, P.

(2020). Disaster recovery

planning in financial institutions. Journal of Business Continuity.

Tan, W.

(2020). AI chatbots for

enhanced customer service in banking. Journal of Digital Finance.

Wang, X.

(2021). Personalized

banking using machine learning. Journal of Banking Operations.

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© IJETMR 2014-2023. All Rights Reserved.